There is a war going on for crypto in the US. It’s not being fought with guns and bombs but with arbitrary rules and hand-wavy concepts.

Today, the SEC charged Coinbase with operating as an unregistered securities exchange, broker, and clearing agency, and for not registering its staking as a service program.

Coinbase is a model citizen for Crypto in the US. It has been a publicly traded company since 2021 and has been a fundamental player in the industry since 2012, onboarding millions into the space. I even purchased my first Bitcoin and ETH there!

I’m not qualified to speak about this topic, so I’ll let some gigabrains share their thoughts.

Adam Cochran, Partner at CEHV:

Jake Chervinsky, Chief Policy Officer at Blockchain Association:

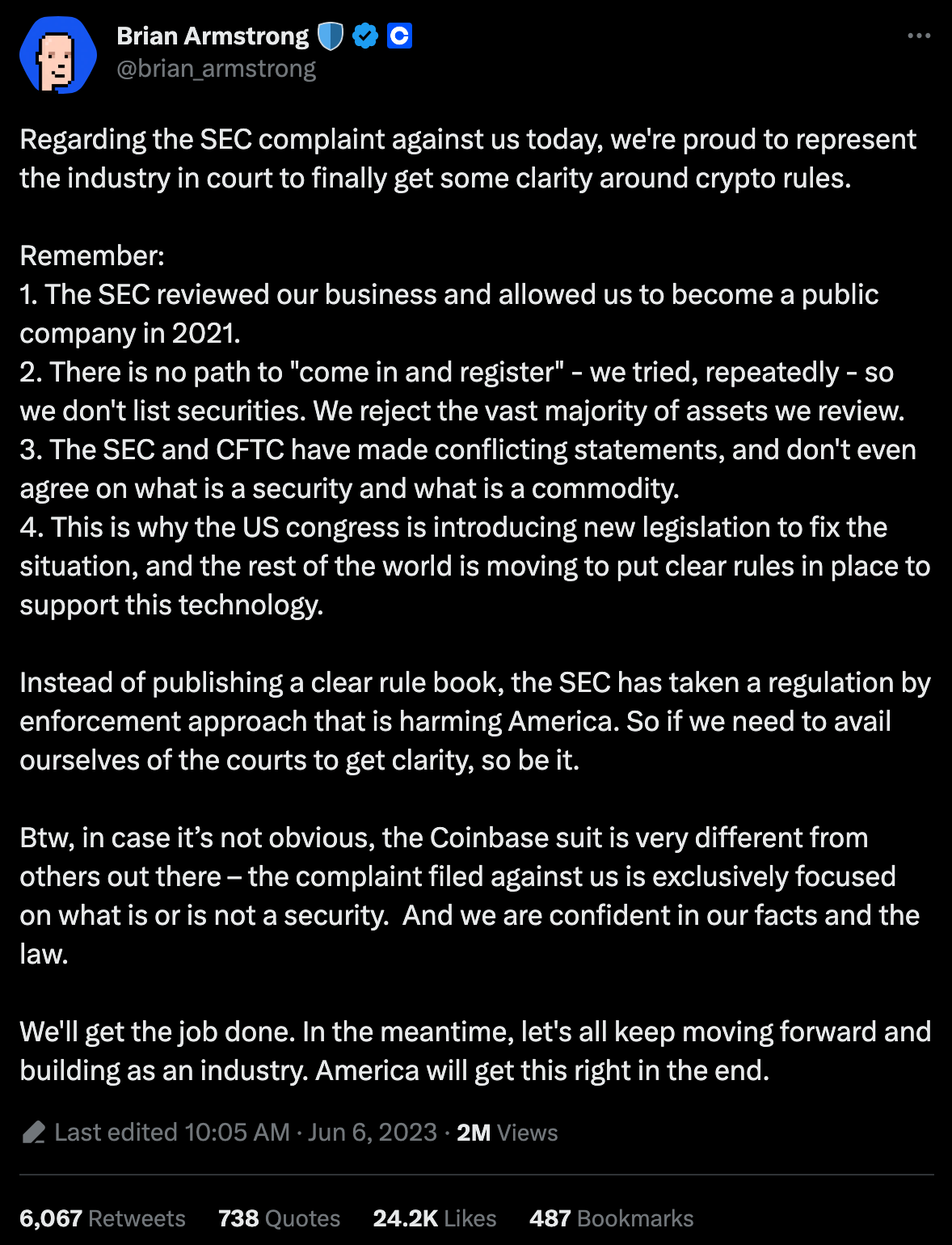

Brian Armstrong, CEO Coinbase:

Ari Paul, Founder BlockTower Capital:

And if you want a 15-second summary of what the SEC has been up to, this meme explains it perfectly:

✊✊✊

Peeling the layers of the exclusivity onion

Earlier this morning I saw a tweet from Farokh about Louis Vuitton’s new NFT collection. Their parent company, LVMH has been actively embracing web3 through their family of brands (eg: Tiffany, Rimowa, and Tag Heuer) over the past few years. Now, those efforts are coming back to the namesake brand.

What do we know about the Treasure Trunk collection so far?

These NFTs will be sold at a price tag of €39,000, or ~$42,000 🤑

Supply: “A few hundred”

Customers based in the US, Canada, France, UK, Germany, Japan, and Australia can register for a chance to purchase

Holding a Treasure Trunk grants access to VIA, Louis Vuitton’s digital collectible hub and community

Registration timeline

June 8th: Registration opens (doesn’t seem like the website has been announced yet)

June 14th: LV will invite select participants to learn more about VIA

June 16th: Treasure Trunk sale begins

Treasure Trunk owners will receive a made-to-order physical twin of their trunk

The Treasure Trunks will be SBTs (soulbound tokens), meaning they cannot be transferred out of the wallet that received them

Treasure Trunk holders will have the opportunity to purchase keys periodically

The keys unlock access to additional products

Products will be revealed to key holders post-mint

New products will include a record of ownership and proof of authenticity

Holders will be able to sell the keys (unlike the Trunks)

The keys unlock Louis Vuitton designs that have never been seen before, and each digital collectible will provide buyers exclusive access to the physical counterpart

The announcement is not surprising considering LVMH has been exploring NFTs and blockchain tech for a while, but what’s interesting is how. Specifically, the last two points.

The move to make the Treasure Trunks SBTs is a smart one for several reasons:

Significantly reduces the motivation to flip the primary NFT by disallowing it altogether

Curates a healthy community from Day 1. A $40k price point reduces the prospective holder base to the diehard fans that probably won’t be worried about a 50% drop in floor price. This is augmented by the presale orientation prior to the sale.

LV can create a permanent deeper relationship with the same Treasure Trunk community vs. different community members joining at different times

The keys also are interesting for several reasons:

LV has combined its history (the brand started by making trunks in the 1800s) and the concept of keys opening trunks that hold valuable goods

The keys ‘unlock’ never seen before designs

The product is revealed after the key is purchased

Putting this all together, we get an interesting framework around the concept of exclusivity:

Few brands can command the price points that LV can, but the way they structure exclusivity is one to consider for everyone building in the space.

Web3 in China

Earlier this week, my fellow writing friend Yaling Jiang shared a Web3 in China report. The report was published last month in partnership with Adiacent, a marketing agency.

The report shows China’s approach to NFTs and web3 while highlighting the similarities and differences with the rest of the world.

Some nuggets I found interesting:

China has regulatory restrictions that materially change the web3 approach. Companies have limitations around:

Accepting crypto as a form of payment

Launching campaigns and events on blockchain-enabled platforms

Issuing NFTs

China has consortium blockchains, which are managed in a centralized manner by businesses or the government

Conflux is China’s only permissionless and regulatory-compliant blockchain, based in Shanghai

Despite limitations, there is a growing digital art and digital collectible scene. Brands like Pomellato (by luxury conglomerate Kering), Moncler, Porsche, LVMH, and L’Oreal have launched NFT campaigns in China.

As someone based in the US, it’s interesting to read about international perspectives and approaches with the same core technology. Check out the report here, and consider subscribing to Yaling’s substack.

See you Thursday!

Bought my first Sats on Coinbase in 2015. They may be infuriating at times, but not deserving of an SEC battle. It really does look like the US is going to be pushed out of crypto and become a 3rd world country when fiat dies. Along with any other countries that refuse to adapt.