#311: Yup - Utilizing Token Balances for Early Access

🔓 How can token balances be more productive?

Earlier this week I came across this post from Yup, announcing the new Yup AI beta feature.

For those too lazy to click through, here’s the video showing how the feature works.

What’s Yup? It’s an app that helps folks to cross-post their content across various social apps (Farcaster, Twitter, Lens, and Bluesky for now), with a focus on crypto-natives. Check them out here or download the iOS or Android app. I’ve used the app before and it’s great for those who are active on multiple social apps.

Utilizing Token Balances for Early Access

What caught my eye wasn’t the feature itself, as other content tools like Typefully and Tweet Hunter have AI-augmented capabilities as well.

It was this line: “Users with 50k+ YUP have early access now.”

$YUP is rewarded to Yup users who post content through the app (more details here). This means token holders who meet the threshold (aka power users), have immediate access to the new beta feature. Those who don’t qualify (aka me) can join the waitlist or DM the team directly for eventual access.

The concept of using tokens or token balances for early/exclusive is nothing new. Yet from my perspective, it still feels relatively scarce and that’s why I felt this example deserves some recognition.

Since starting this blog, I’ve observed or ideated on various applications of this concept:

#6: BAYC’s 2022 token-gated merch drop (at the time it was pretty novel!)

#86: Smoothie and early access to products based on point balances (unfortunately shut down)

#231: RTFKT’s mobile app and early access based on NFT holdings (app is being revamped)

And now we’re seeing another practical application of token holdings leading to access to something meaningful.

Utilization > Financialization

The other reason Yup’s approach is interesting is because they’re focusing on utilization over financialization across two angles:

Utilization of the token: The token isn’t just a financial asset. It is a utility-oriented asset that unlocks early access to new features in the product.

Utilization of the product: The primary way to receive more of the token is to use the product itself.

The utility vs. financial aspect is certainly debatable, but there are a few signals (not comprehensive) which suggest YUP is focusing more on utility, at least for now.

Token performance: YUP’s value has dropped significantly over the past several months, as users have likely continued selling the tokens they earn from product usage.

Cost of early access: If someone wanted immediate access to Yup AI, they would need to pay $1,850 (50k*.037). Terrible deal lol.

Early, not exclusive access: The 50k threshold is for early access, not exclusive access. As mentioned earlier, this is not the only way to get early access as you can DM the team or sign up for the waitlist.

If this was meant to increase the token value it didn’t work: If the goal of the 50k YUP requirement was to increase the token price (IMO it wasn’t), it didn’t work as the price barely moved up over the past few days.

Because of these reasons, I view Yup’s early access as a way to reward power users, encourage existing users to use the product more, and focus on the long game of building a successful product vs. price go up.

On the points of early access being cost prohibitive and it being early (not exclusive access), what is happening is they’re strengthening the usage flywheel with rewards that are nice incentives but not to the point where they’re a liability or distraction.

Levers to pull to incentivize action

The Yup example probably doesn’t directly apply to everyone nor is it comprehensive because some products don’t have a token, while others are categorically different. There are obvious regulatory considerations as well. That said, various levers can be experimented with:

Change the threshold: Increase or decrease the token requirement based on the predicted desirability of the feature

Add a time-based component: Reduce (or increase depending) the token requirement every day/week/month based on the feature rollout timeline and the capacity to address bugs

Stake or burn to access: If holding a certain amount of a token isn’t enough, staking shows even stronger intent for access if the incentive is juicy enough. Burning would be the strongest version of showing intent/interest.

Stake with progressive unlocks: Another variation of staking could be with unlocks to withdraw based on time, usage, both, or other criteria such as providing feedback.

Tiered access based on holdings: The more you hold or the longer you’ve held, the more access you get, especially if a feature will incorporate a credit or number of uses approach.

Historical behavior: You get access if you haven’t sold the token in the past X days/weeks/months or ever. This could be binary (you get access or don’t) or more nuanced.

These levers can be incorporated separately or layered on top of each other in interesting ways.

Where does this exist outside of crypto?

There’s nothing completely new with what Yup and others are doing. The concept of holding or engaging to get early/exclusive access exists elsewhere, especially around financially oriented incentives.

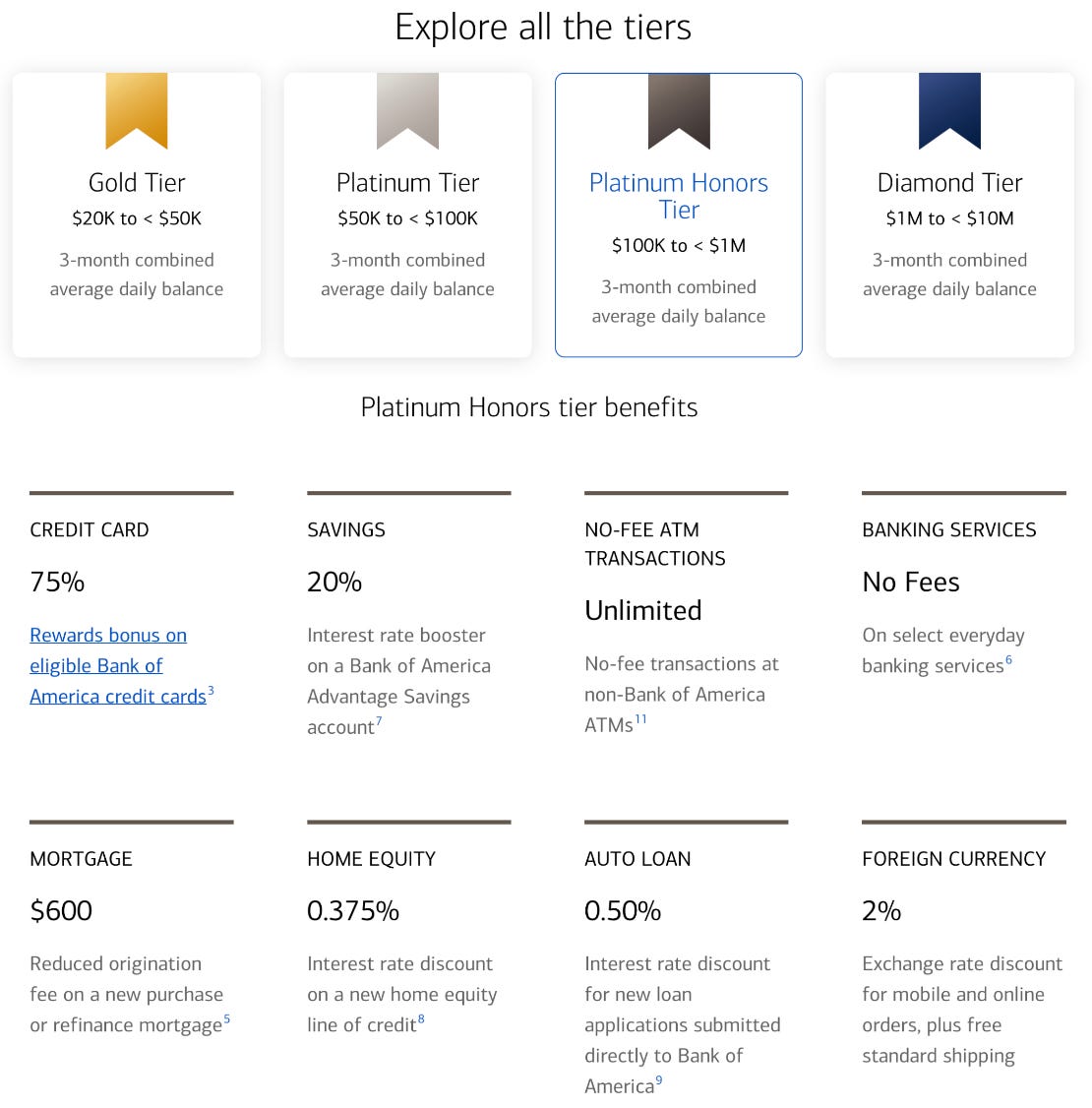

Banking: Having a combined average daily balance over a certain amount and receiving additional benefits with the bank’s products. This has parallels to ‘holding at least X amount’ of a token.

P2P Marketplaces: If you reach certain seller thresholds you get reduced fees.

IPOs: Several tech companies have offered directed share programs for their ecosystem participants, with the most recent notable one being Reddit offering this to certain mods and users. Uber offered this to their drivers for their 2019 IPO and Airbnb offered this to their US hosts in 2020.

I hope and expect that we’ll see more interesting variations of providing utility-oriented benefits for token holders, and across a wider variety of criteria. A lot of levers have yet to be pulled 🕹️

Other interesting things

1,255 projects were created during Base’s Onchain Summer Buildathon. You can check them out here.

Qiao from Alliance shared H1 2024 trends based on the applications for their startup accelerator

Electric Capital created a Crypto Market Map which includes 1,562(!!) projects 🥵. I wish there was a search function, which I imagine they’ll eventually add since it’s in beta.

I want to get to know my readers better, fill this out if you want to connect

See you next week!

thanks TPan,

De Social is the trend new hype web3