Did ya miss me? 😉

Maybe you used that extra time to catch up on older TPan pieces, spend time with your kids, or call a loved one. Maybe you realized you don’t read this newsletter and will unsubscribe after seeing this piece in your inbox (I have 22 subscribers now after 100+ pieces).

Want me to write about your Web3 product?

Before I headed out to my friend’s wedding last week, I had an idea to publicize an offer to write about Web3 companies.

If you’re interested in me writing about your product, tune in next time and give me a follow on the bird app!

Though my capacity is limited, I hope to do this regularly if it goes well. I’ll be selecting one company on Twitter and another on Farcaster by end of the day today.

Debit Cards

I came across this tweet from @TheFirstMint earlier today:

More info about the partnership here.

Whoa that’s fun, what’s going on here? I’ve never heard of hi. Also, the h is not capitalized. Capitalization is a boomer thing (guess I’m a boomer 👴🏻).

hi is a European crypto-focused Neobank that also has a utility token. Token staking leads to benefits depending on the amount staked.

This reminds me of Crypto.com’s credit card and tiered staking incentives.

The hi debit cards will be available in 25+ countries in the EEA (European Economic Area).

Why did this news pique my interest?

The NFT customized card “will support a limited range of NFT collections including CryptoPunks, Moonbirds, Goblins, Bored Apes and Azukis”.

The card doesn’t support every NFT collection, only the most established ones (I’m assuming Goblins is for the culture, heh)

“NFT owners will be asked to verify that they own the NFT in order to apply for card customization.”

I’d be curious to know how hi verifies NFT ownership with this phygital application.

“As consumer interest in crypto and NFTs continues to grow, we are committed to making them an accessible payments choice for the communities who wish to use them. We are proud to be working with hi to continue to drive innovation in the market and enable these customizable cards together with the safety and security you’d expect from Mastercard.” says Christian Rau, Senior Vice President, Crypto and Fintech Enablement at Mastercard.

Companies and innovation follow the money. I imagine companies like Mastercard and Visa have a LOT of financial data on crypto and NFTs and want to be on top of the ball with this one.

I wonder what adoption will look like for this offering from hi. Is having your NFT on your debit card cool or tacky? Does it even matter if NFC adoption is on the rise, or is this solely a marketing/PR play?

Lastly, flaunting your NFTs (even the merch) is something to be careful with. Crypto is down bad and most NFTs are becoming worthless, but that doesn’t mean you won’t be a target for theft.

The top NFT brands are fundraising

There have been rumblings of a fundraise for Azuki, one of the last established NFT brands that has not announced a funding round.

If we look at the top 20 NFT brands by lifetime transaction volume, we see that venture capital is heavily involved:

What does this tell me?

This is a ‘raise to play’ environment (get it, instead of ‘pay to play’? 😏 ok just me). This doesn’t mean you can’t be a successful NFT company or brand if you don’t fundraise. But scaling is hard and capital helps big time.

The world of NFTs is volatile. Secondary royalties are a helpful source of revenue, but is an unreliable one with volatile price swings and the threat of marketplaces like Sudoswap neutralizing secondary market royalties looming. Venture capital helps provide runway and for lofty visions to be executed in addition to industry connections.

This is based on public information. Cool Cats is rumored to have a funding round in the past, and may be continuing to fundraise in the background. It’s also possible that the team wanted to focus on locking down a CEO before announcing other developments like fundraising. I wouldn’t be surprised if World of Women is in a similar situation.

We’ll see if the Azuki rumors are true (I think they are). If so, it feels like the first generation of leading NFT brands has been established.

Some will continue to grow, some may fail and get acquired, and some may get surpassed by the next generation of NFT brands.

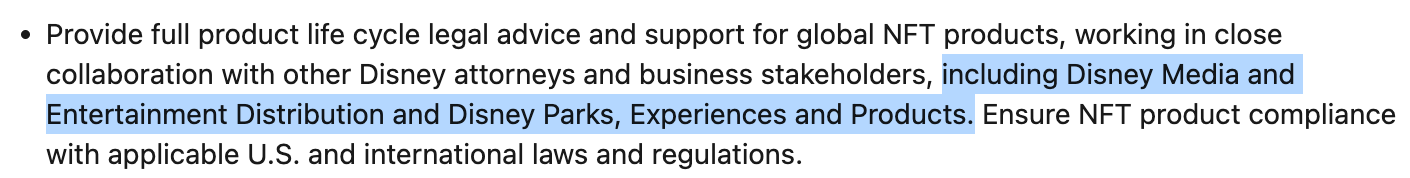

Disney makes it official

If it wasn’t already clear that Disney is going to get into Web3, they made it explicitly clear over the weekend.

51 applicants so far, not bad. Maybe I should apply for fun?

Why is this a big deal and why legal?

Disney is a $180B company. They have one of the biggest portfolios of intellectual property in the world, if not the most coveted.

Disney is a complex organization. They’re global, has multiple business lines, and a treasure trove of IP. Legal is arguably the biggest consideration for any new effort they consider.

The Web3 space is nascent and evolving rapidly. Disney is ok with that and shoring up risks by hiring an in-house legal partner to assist.

The job description gets me excited because of what I’ve written about Disney in past pieces:

If you read between the (literal) lines, Disney is leaving no stone unturned. They’re thinking about:

Web3 applications for every major Disney business line

Looking at the whole Web3 ecosystem: NFTs, blockchains, marketplaces, and digital currency

Advertising and marketing: This new tech won’t be selling itself

Disney’s CEO confirmed the Web3 focus at the D23 Expo fan convention a couple weeks ago. Paraphrasing from the article:

Earlier this year, Disney hired Mike White to lead the newly formed Next Generation Storytelling and Consumer Experiences unit.

In addition, they also hired Mark Bozon for their metaverse creative strategy. Notably, Mark spent 12 years at the tech giant Apple before joining Disney.

Disney wants to use data from the physical and digital worlds to drive its metaverse policy, says the CEO. Data from theme park visits and consumer streaming habits are two sectors Disney is considering for their metaverse strategy.

What would I consider if I were at the House of Mouse thinking through business strategy?

Build vs. Buy vs. Partner - Make tradeoffs and determine what Disney should build in-house, buy Web3 native IP or tech outright to accelerate development, and partner with other players in the ecosystem to learn and strategically plant their flags.

In the world of buying, there is an emerging opportunity to scoop up high potential IP that is struggling in the current environment. Many of these brands already have established communities and could complement Disney’s various business lines.

I would build case studies around projects that were failing and changed hands like Pudgy Penguins, Super Shiba Club, and 0n1 Force:

Why did these brands fail?

How are these brands being revived?

Was the revival successful?

If so, how did it become successful?

Rethink IP and partnerships - Disney understandably will hold their existing IP close to their chests. However, the world of IP in Web3 is evolving rapidly. Could Disney take a page from RTFKT/Nike’s playbook to test and iterate quickly?

Who knows, maybe Disney still won’t get into Web3, but they sure are interested. Which Fortune 500 company is next?

See you tomorrow folks!

I'm loven it!