Before we get into it, our favorite SEC Commissioner, Gary Gensler wants to send us a warm holiday greeting!

Christmas? Nope, it’s Pi Day.

This tweet is the classic definition getting ratio’ed, or when there are more replies than likes or retweets. This usually indicates a bad tweet if you’re the one tweeting.

I’ll let you read the replies, not many Gensler fans on Twitter.

Alright now that we’re warmed up…

When $1≠$1

As we all know, the US banking system was at a precarious position over the weekend. Multiple banks were shut down, business owners were frantically figuring out how to make payroll, and the government was burning the midnight oil determining what the best course forward would be.

If you’re not familiar with what happened, I’d recommend watching or listening to this overview from Coffeezilla.

Fortunately, we survived the weekend in one piece and markets seem to be feeling some euphoria for now.

What caught my eye while doomscrolling Twitter for hours over the weekend was USDC. As a newbie that is slowly starting understanding DeFi more, I found the USDC depegging particularly interesting.

So what happened, why did it happen, and where is it now?

What the heck is USDC?

USDC = USD Coin. 1 USDC = 1 US Dollar.

Because USDC is a digital dollar, it can be used for transactions much quicker than traditional means and is not limited to business days in traditional finance. Additionally, USDC can be exchanged for cash.

USDC is a stablecoin, meaning its value is stable relative to the US Dollar. There are other stablecoins, with the other major ones being Tether and DAI. Each stablecoin has a similar goal of being the equivalent of $1 US Dollar, but is backed in different ways.

USDC is managed by Circle, a fintech company that creates payment and investment products for individuals and businesses.

So far, so good.

What happened to USDC over the weekend?

Well…this.

What does this chart tell us?

This chart compares the value of USDT (Tether) vs. USDC. Both are stablecoins pegged to the US Dollar. 1 USDT or 1 USDC = $1 and therefore normally hold equilibrium at $1

Over the weekend, the value of 1 USDC dropped to as low as $0.88 for 1 USDT, meaning that people were swapping their USDC for less than what it is supposed to be worth

Over the past couple of days, USDC has ‘repegged’ to $1

So what caused the volatility?

On Friday afternoon, Circle announced that Silicon Valley Bank (the main character in the weekend craziness) was one of the banking partners Circle uses:

What I found interesting with the wording is that Circle shared that SVB is one of the six banking partners Circle uses for managing ~25% of its USDC cash reserves. “One of six” and “~25%” is sorta hand-wavey to me. That said, they may have worded it this way for legal purposes, that’s beyond my knowledge.

Also, this all happened before what we know now, which is all the Treasure 🤝 Fed 🤝 FDIC announcement that all depositors would be made whole, including Circle.

Later that Friday evening, Circle got more specific:

Shortly after, other financial apps made moves to limit USDC redemption, causing further panic.

Over the weekend, viral videos surfaced of lines outside ATMs and bank branches with customers pulling out their deposits. A version of that happened digitally as well with this news.

Smarter and cooler heads saw this large imbalance as a trading opportunity and actually bought USDC over the weekend, with the bet that USDC would return to its $1 peg.

In hindsight, smart move!

What else happened?

Curve

Another great resource I came across thanks to Crier and Gr0w and my conversations with them at ETH Denver is Curve. Curve is a DEX (decentralized exchange) focused on stablecoins.

One of their largest pools (think of it as a currency exchange kiosk at an airport) is 3Pool, which consists of DAI, USDC, and USDT.

As the chaos ensued Friday night and everyone was trying to exchange their USDC for something more secure, the typically balanced pool got severely lopsided. People were swapping their USDC and/or DAI (because a portion of their reserves consist of USDC) for USDT, resulting in the USDT portion of the pool being nearly depleted.

The pool will slowly rebalance over time, but this shows the resiliency of decentralized protocols like Curve. Things can bend, and bend really hard. But they don’t break, and they don’t need the intervention of a third party.

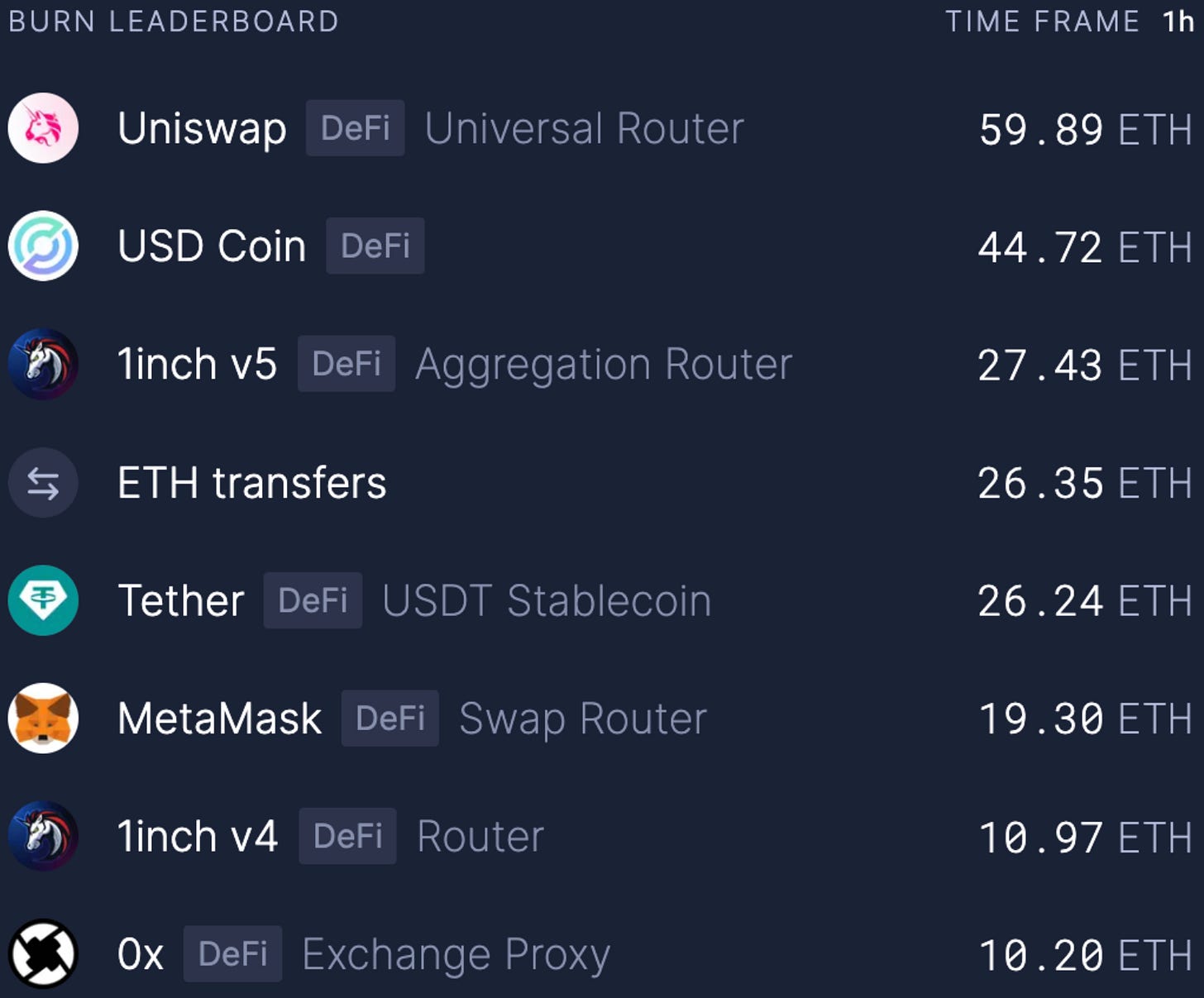

This was observed across other exchanges with liquidity pools as well, such as Uniswap.

Gas

Gas is the fee users pay to a network to ensure that a transaction gets processed. The higher the gas, the faster the transactions gets processed. If everyone is trying to process a transaction, the higher the gas fee is.

If you think gas is expensive at the pump, be happy you weren’t paying for Ethereum gas over the weekend.

On Friday night, gas spiked to 200+ for a period of time, which is pretty wild when you consider the fact that all the transactions that were happening were pretty much related to swapping stablecoins and crypto instead of people buying NFTs.

So what?

Thanks for explaining TPan. What does this have to do with web3 growth and marketing? IS THIS TURNING INTO A DEFI NEWSLETTER?

Maybe? Just kidding, it won’t. I think…

However, it’s important to understand how external events impact any business, role, or function.

The Butterfly Effect describes how a small change can have a large impact change somewhere else. Clearly, the events of this past weekend were not a small butterfly but a large jumbo jet flapping its wings while potentially nosediving into the runway.

When we look back at our business metrics in web3, it’s clear things looked strange over the past few days. However, the continued secondary and tertiary impacts have yet to play out. Understanding how communities and users are responding in the ongoing aftermath may impact future strategy and tactics for deployment.

See you Thursday!

Thanks Tpan for In-depth Explanation.

Good one as always. I made the cut again! 🎉🎉