I’m this 🤏 close to unsubscribing TPan!

Alright, alright I concede.

When you see headlines like these dunking on the social media darling that lasted a week (or maybe 2 if we’re being generous), it’s easy to join the haters. After all, the numbers don’t lie.

These headlines annoy me because they give “NFT Trading Volumes Collapse 97% From January Peak” energy. It doesn’t really dig into what’s going on.

I’m going to make the argument that FT is punching above its weight, shaking off the speculative behavior that is inherent in crypto/web3, and is setting itself up to have staying power — either for itself or discovering new territory for creators to explore. Hat tip to Bitclout being an earlier trailblazer on this front as well.

Also, if you haven’t read my piece on FT from last week, it might be helpful to read that first.

friend.tech is not just a social media platform

It’s a membership platform with pre-defined monetization mechanics baked in:

Supply: Creator/Influencer access in the form of keys

Demand: Purchase keys to access chat with creator

Access: Closed

Direct Monetization from demand: 10% protocol fee (5% to FT, 5% to creator) for key purchases or sales

In a way, many other social platforms actually operate similarly. The financial aspect is just less obvious:

Youtube

Supply: Creators, channels, and videos

Demand: Viewers, time spent watching videos

Access: Open

Indirect Monetization from demand: Ads, sponsorships, links to merch and other products in content

Tiktok

Supply: Creators and videos

Demand: Viewers, time spent watching content

Access: Open

Indirect monetization from demand: Ads, sponsorships, TikTok Shop, TikTok gifts

Twitch

Supply: Creators and livestreams

Demand: Viewers, time spent watching content

Access: Open

Indirect monetization from demand: Ads, sponsorships, donations, subscriptions, Twitch Bits

Note that when I refer to direct vs. indirect monetization, FT’s creator monetization model is relatively more direct with the simple key purchase/sale versus something like TikTok gifts:

User purchases coins from TikTok

User purchases gifts with coin balance

User sends gifts to TikTok creators

Creators convert their Gift points to diamonds

Creator converts diamond balance to $ and can cash that out

(Tiktok takes a 50% commission from creators on Gift earnings)

So is FT like the above platforms? After spending more time on FT, the current iteration is more like Patreon (or Substack) if anything.

Patreon

Supply: Creator access and premium content

Demand: Fans and community

Access: Closed

Direct monetization from demand: Subscription for access to supply

The biggest differentiator is the pricing model and how much the creator takes from the transaction.

By comparing FT to other creator platforms and breaking it down into different parameters, we see a lot more similarities than a first impression would suggest. However, the differences are glaring and quickly departs from what is considered best practice.

By shifting the understanding of what the hell FT even is, it changes how creators approach the platform and what users should expect when purchasing keys. That said, FT isn’t even a month in Beta, so what is today may be significantly different than what it might be in a few weeks or months, if it makes it to that point.

Progressive Web Apps showing their strengths

FT was my first time using a progressive web app (PWA). The advantages of PWAs are clear with bypassing the 30% platform fees that App Stores impose and guidelines.

However, experiencing the quick iterative potential of what PWA’s could do was impressive as a FT user and creator. A couple examples of this:

Explore Tab evolution

V1: Was a feed of all key purchases/sales (this has moved to the Home tab, under Global)

V2: Added a Trending category based on the top volume from accounts in the past 15 minutes

V3: As volume slowed down over the past several days, the trending category started showing newly created accounts with 0 volume. This was probably due to their trend filtering logic. Now the Trending category omits those newly created accounts with 0 volume.

These changes all happened in about a week.

Prediction: The Explore tab will actually become a proper Explore tab with more categories, topics, and ways for users to find new creators that fit their interests (based on existing key holdings, who they already follow on Twitter, etc). Additionally, there might be a way for creators to share previews of their chats to attract prospective key holders.

Status Indicator

At some point yesterday, I noticed that FT added an ‘online now’. A great way to show that creators are active and that they are more likely to respond to messages.

There were likely more changes than just this, but imagine making all these UI improvements, submitting them to the App Store, waiting a couple days for app approval, then pushing the new version live. Keep in mind some users like myself don’t set their apps to auto-update. Just because you push a new app version doesn’t mean everyone is on it.

PWAs allow for rapid iterative improvement in ways that a proper mobile app can’t. On top of that, some apps are hundreds of MB which is a lot of data for some international folks where mobile data isn’t considered a commodity.

If PWAs do take off, expect App Store ecosystems to clamp down or ensure they get a cut of that emerging market.

What does success look like from a KPI POV?

The ‘FRIENDTECH IS DEAD’ narrative is easy to make. When you see a chart like this, it sure looks like it.

And if you’ve been in the space for some time, you’ve seen a variation of this chart countless times.

However, I would make the argument that transaction volume shouldn’t be the only KPI for what success looks like.

Transactions volume spikes for a couple reasons:

Airdrop speculation encouraging users to buy and sell keys at scale

New waves of creators onboarding (eg: FT added the feature to upload photos on August 24th, leading to a longer sustained peak when it was already on the way down)

So after the initial waves of speculation, the creators and users left go through a phase of creator discovery. In many ways, this is like price discovery in finance.

Price = Price of a key

Asset/Commodity = Access to the creator via the key, not the creator itself. This is a small detail but changes the psychology of how a creator should view the ‘price’ next to their name. It’s the price of access, not their actual value.

Marketplace = IMO FT is a creator platform with marketplace dynamics built in due to the bonding curve pricing logic

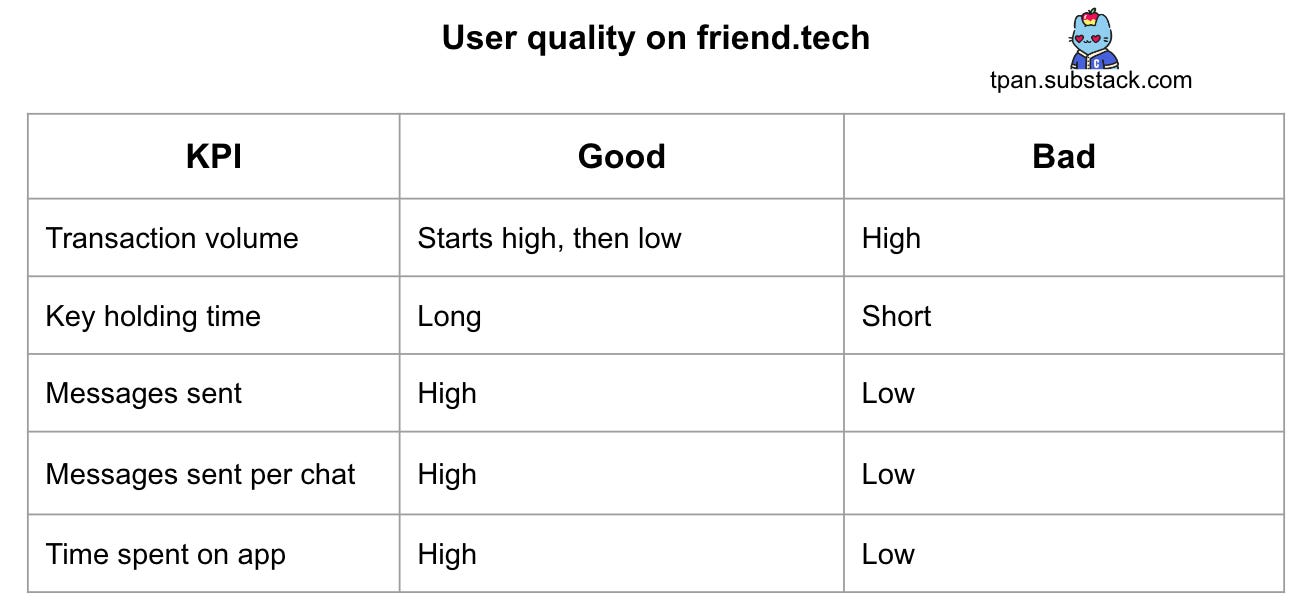

So if we think about what a ‘good’ FT user looks like versus a ‘bad’ FT user.

With this logic in mind, less spiky transaction volume is probably a good thing. There needs to be a constant flow of new users coming in, but for the right reasons and with the right user behavior.

Tokens and speculation around an airdrop are a great strategy to bootstrap initial user growth, but can lead to high volume of undesirable behavior.

We can think about this similarly with FT creators

To complement the above points, FT shared some stats earlier today, which is pretty cool since they’re so early. Onchain data can tell us a lot, but it doesn’t reveal app usage metrics.

The chart that interests me the most is their retention chart. I expect Day 7 retention to dip further as the airdrop farmers, some creators, and lukewarm users churn out. Then I expect that 7 day retention chart to level off, allowing the FT team to identify their core creators and users (early product market fit) as well as the numbers they need to grow sustainably.

Once there’s enough data, FT can add a Day 28 retention metric and break out metrics further by cohorts, creators vs. key holders, etc.

How might the friend.tech airdrop work?

The gift and curse that is the airdrop is an interesting one when it comes to FT and suggests where the future of airdrop logic in general may be headed.

Historically, qualifying for an airdrop was straightforward and simple. Just use the damn thing and do it with volume.

However, a couple of notable airdrops modified that logic:

Blur: Introduced a combination of seasons weighted towards the usage of new features, box rarity, loyalty boost, along with public leaderboards

Arbitrum: Focused on criteria based on transaction volume, transaction value, transactions across multiple smart contracts, and transactions across distinct months indicating consistency. Based on the number of qualifying actions a user achieved, they were assigned a point value that corresponded to an airdrop amount.

FT seems to be taking a more complex approach with their points airdrop as well. Although this isn’t official, Levi (one of the top FT accounts) is at least directionally correct with the point distribution logic last week:

Week 1 was straightforward: Get the FT user base to be comfortable with buying and selling keys.

However, not too comfortable. High volume is not necessarily a good thing.

Week 2 was focused on time x value: Encourage users to go through the creator discovery stage.

The next few weeks’ criteria would probably incorporate other factors such as message volume, response times in your chat, time spent on app, or usage of new features like photos.

If this is true, it would align with my earlier assessment of what it means to be a ‘good’ user or creator on FT. Airdrops can incentivize ‘good’ behavior if used properly. And good behavior isn’t always based on transactional value or volume.

The battle for supply creators

For social and creator platforms it’s all about supply, aka creators.

Why did Kick (Twitch competitor) sign a 2 year, $100 million, non-exclusive deal with xQc?

Supply acquisition, which is an indirect form of user acquisition.

FT is doing the same. By attracting the right creators onto its platform, they won’t need to worry as much about demand. The creators will take care of that if they’re treated well.

My gut tells me that:

Airdrop criteria will slowly skew towards creators and positive creator behavior

The points will be used to unlock additional features in the FT app, allowing for new ways to engage, provide value, and monetize. It will also be a token that can be traded, but it is a utility token that can be used once launched.

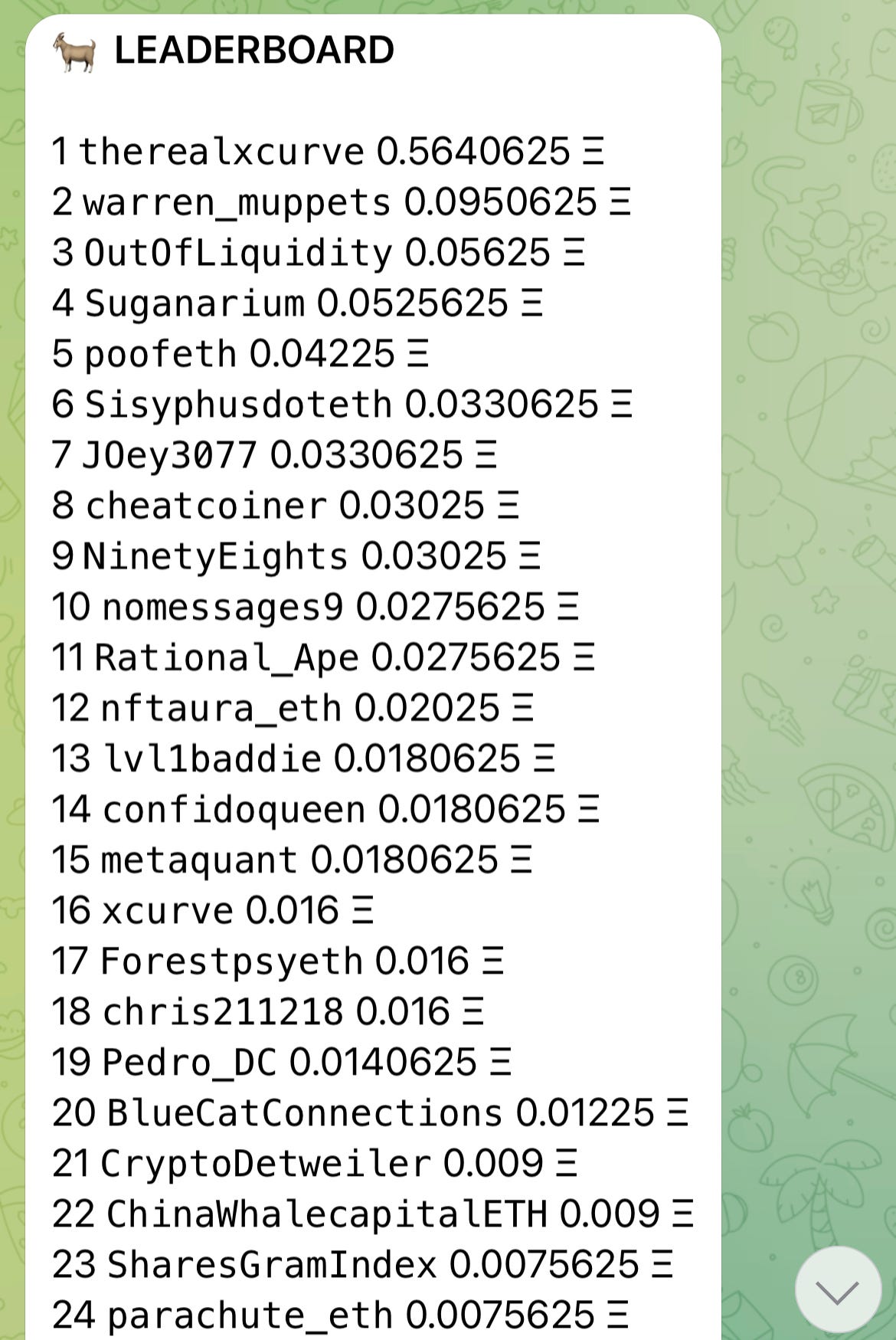

Other competitors have already popped up over the past several days, with one of the more notable ones being Sharesgram:

Built on top of Telegram, which allowed it to launch quickly

Launched a token prior to the product launch to drum up interest

Token holders receive revenue from trading volume, taxes, and referrals

This sounds good in theory (and heck, might actually work out), but this is where IMO there is a fundamental misunderstanding of what FT is trying to build.

By creating a token and launching it prior to the product launch it:

Focuses attention on the token vs. the product

Focuses on demand (users/speculators) for the token vs. demand for supply (creators)

Prioritizes financial incentives vs. non-financial incentives from supply and especially demand

Success for Sharesgram will be around the creators, not speculation for the token. The fact that the bond curve is exactly the same at FT’s tells me it won’t last long 🤔

That said, you can make a lot of money if you’re a savvy trader, and I’m jealous since I’m terrible at that 😅

FT has made a prudent decision to be patient with launching a token or whatever the airdrop will ultimately be.

Where to from here?

FT still has a massive uphill battle. They made it past the cold start, but now they have the keep the engine warm.

Their current bonding curve mechanics limit the ceiling for how large a creator’s audience could be, especially for larger ones (migrating to a v2 smart contract would solve this and may eventually happen).

The app is still buggy and I’ve sent messages that don’t go through and I have to rewrite the thing.

And this particularly sucked since I’m long-winded at times 😮💨

However, I think FT is pushing the boundaries of not web3, but the creator economy.

Last week Andrew Chen of a16z published a new piece on the Creator Economy 2.0 (emphasis mine).

Thus, I argue that the future of the Creator Economy continues to be promising, but the approach has significantly evolved and the bar has been raised. Startups will need to provide new functionality, create new forms of monetization, and adopt new technologies that make them more defensible to competition and in-house efforts by creators to replace them. Personally, I’m much more interested in Creator Economy startups that are AI- or video-first, and act more like marketplaces in providing a highly managed solution to both sides. I’m more bullish about startups that know how to collect $1000 from a smaller niche of users — thus creating more value — rather than a tip jar model that collects $2 from everyone.

We’ll see if FT cracks the Creator Economy 2.0 nut or not, but I can confidently say (a week later lol) that they’re pushing the boundaries of what it can look like.

And because of that, I’m a fan.

See you Thursday!

Friend Tech gave off major clubhouse vibes

Idk why