#236: Opening Pokemon Cards Onchain with Courtyard

PLUS: 🎰 The Casino on Mars by Matt Huang of Paradigm

We all like a little surprise and delight in our lives, even if we’re not the type of people who like surprises.

This happens in the more mundane parts of our lives like when we request an UberX but get matched with a premium Tesla, or in a more gamified fashion like gacha mechanics in mobile games or blind boxes with physical collectibles.

NFTs have added more layers to the reveal process, with additional surprise and delight mechanics :

Instant reveal: NFT is revealed upon minting

Manual reveal: NFT is revealed based on the holder’s preference

Trait reveal: Additional aspects of the NFT are revealed at certain points in time

But what happens when you combine the best of physical and digital collectibles, along with the reveal mechanics? You get something like…

Courtyard’s Pokemon Stress Test Drop

What’s Courtyard? It’s a platform that tokenizes and vaults physical collectibles like trading cards, sneakers, watches, and coins.

I learned about the company earlier this year at ETH Denver, and the idea of bringing physical collectibles onchain was planted in my head from then on.

Yesterday, the Courtyard team held their ‘Stress Test: Break Courtyard.io’ drop: 175 packs (1 card per pack) at $5 per pack. Each of these packs/cards is a NFT on Polygon, representing the physical card, and can either stay at their Brinks-partnered vaults or be redeemed for the physical card.

These packs were a great deal for anyone who enjoys the thrill of ripping packs and Pokemon cards, with many of the cards worth considerably more than $5. Due to the price, the packs sold out in less than a minute, with the influx in demand helping Courtyard stress test their website and backend.

Why does tokenizing physical collectibles make sense?

The global sports trading card market was estimated to be valued at $12.6 billion in 2022 and is expected to grow to $23 billion by 2030. Those figures don’t even include trading card games like Pokemon or Magic.

When I was at Walgreens yesterday, I stumbled upon a pile of Pokemon ‘Trick or Trade’ Booster Bundles: 40 mini-packs of Pokemon cards, with 3 cards in each pack. If you want to give kids something other than candy but don’t want to be that person giving apple slices, these are probably a better bet.

More notably, we’ve been seeing a gradual shift in the card collectibles space and how consumers are interacting with them.

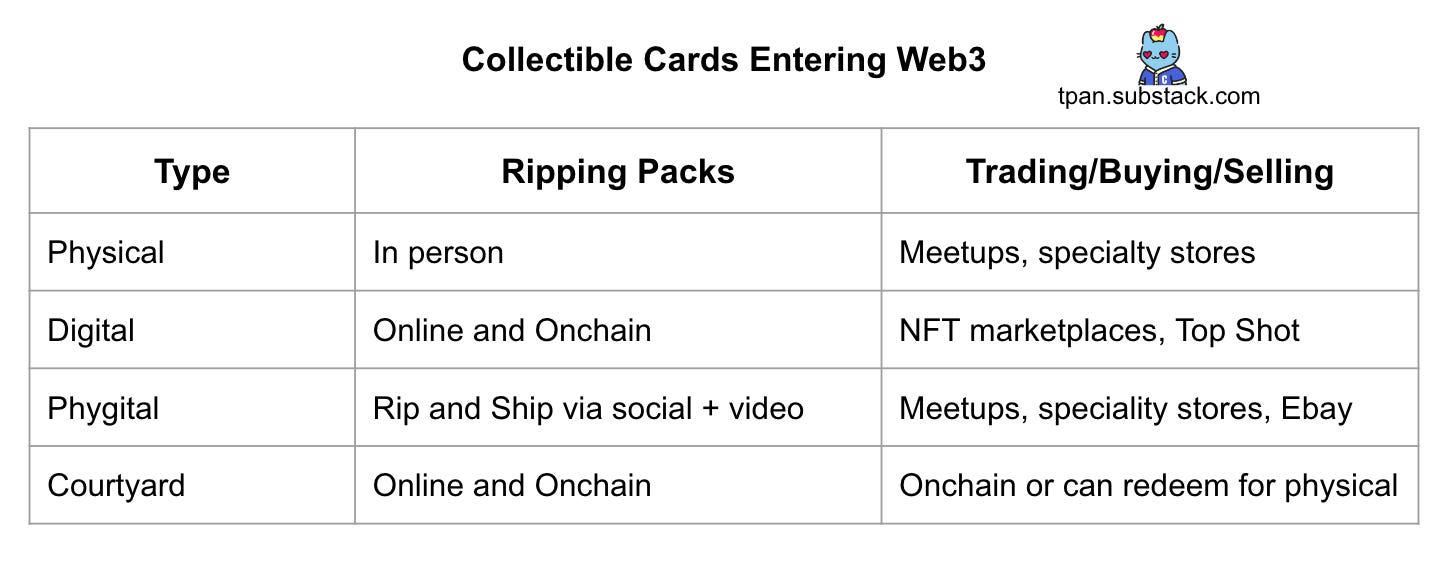

Physical: Consumers purchase packs of collectible cards and open them. This has existed for decades and will continue to exist.

Digital: The emergent form of digital collectibles as we all know, and this includes trading cards. NBA Top Shot is a prominent example of this

Phygital: What Courtyard is doing in the emerging tokenized RWA (real-world asset) space. The physical form of the collectible exists, but direct ownership is represented via the NFT and can be redeemed if preferred.

The Museum of Mahomes is another example of this concept, where fans can decide to purchase either the physical product directly or the digital product that could be redeemed for the physical at a later time via burning.

With the spectrum of the established and emerging formats with trading card collectibles, we can look into some of the behaviors that are prevalent in this space.

The emergence of ‘Rip and Ship’

With the popularity of live-streamed content, COVID, and the gamification of…well, everything, the concept of ‘Rip and Ship’ became popular.

Instead of purchasing and opening the packs yourself, you could purchase packs from a content creator and they rip the packs for you, repackage the contents, and ship them to you.

Sounds stupid, right? TPan likes stupid because then he gets to dig into why people do the ‘stupid’ thing.

Why participate in overpriced packs of cards and outsource the excitement of ripping to someone else?

Availability: Especially during COVID, popular collectibles were hard to find. Some people got their fix through Rip and Ship creators and purchased packs off of them.

Creator Economy: Participating in Rip and Ship is a way to support content creators. It’s also a form of co-creation — You have an indirect role in creating the content.

Entertainment: It’s a different form of the same experience. Just like watching others play video games on Twitch, sometimes people like to engage by spectating vs. actively participating.

Affordability: For rare boxes, you may not be able to afford the whole box, but want to participate in one of the pack rips.

So why did I spend all this time explaining ripping and rip and ship? There’s one more step in the process of these physical collectibles.

Authentication and grading

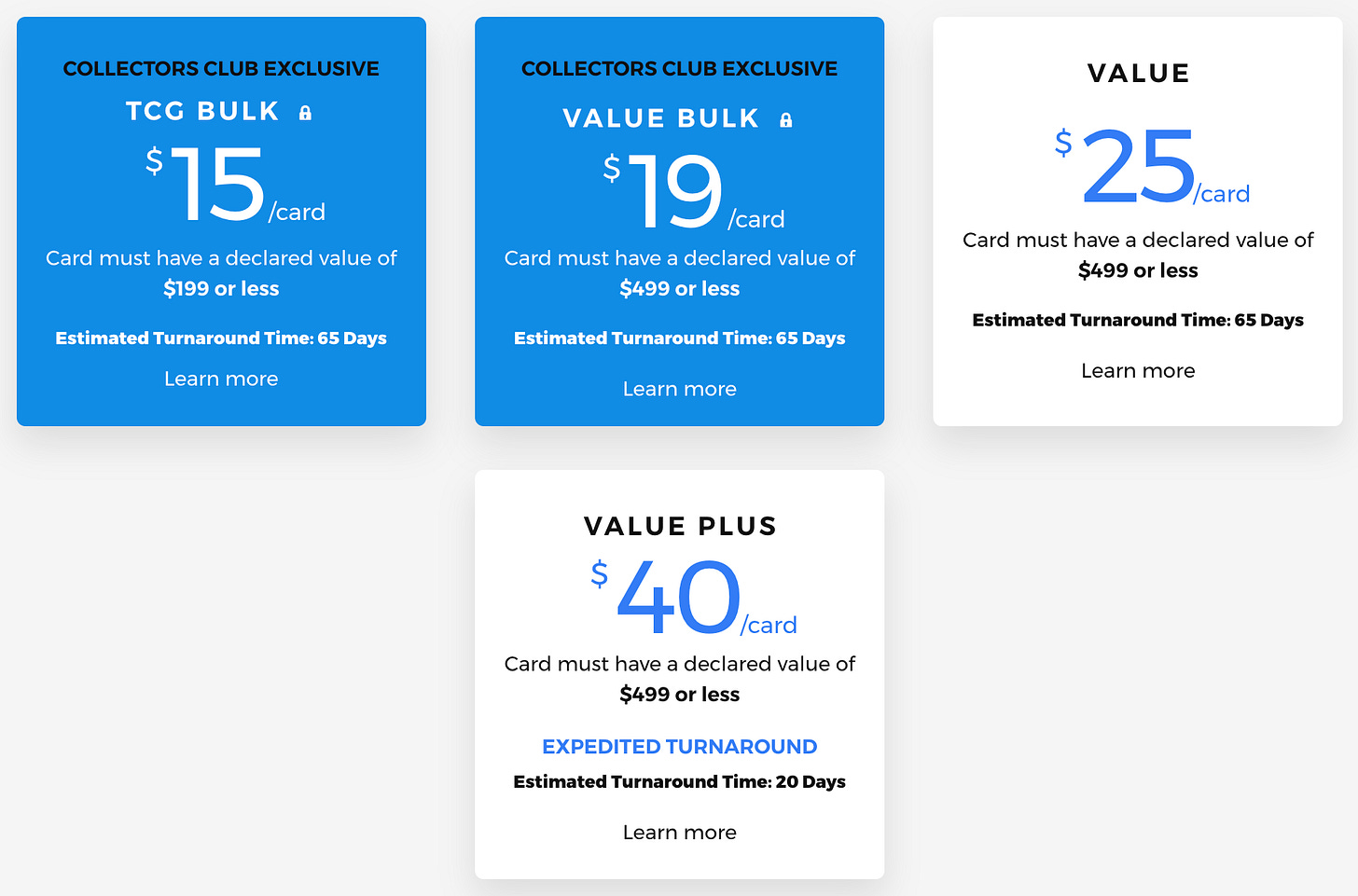

How do you know the card is real? How do you know if one card is in better shape than the other? This is where authentication and grading companies like PSA, BGS, and CGC come in.

If you pull a rare card, how do you prove it’s rare? With the blockchain, this is a simple answer. In the physical world, these grading companies are effectively the judge, jury, and executioner (hopefully not this).

These companies help to establish norms around quality and rarity, but also are expensive and take time.

Items on Courtyard are already authenticated and graded, which saves a step for prospective buyers and creates more consistency with listed assets.

Bringing it back to Courtyard

IMO, what is Courtyard’s thesis?

Ripping physical packs is fun

Ripping purely digital packs is fun and an expansion of the existing behavior (NBA Top Shot, NFT reveals, etc.)

Ripping physical packs via digital means is normalized with, and has been accelerated by COVID, the Creator Economy, and livestreaming

Grading is a resource-intensive process (time and money)

Tokenization streamlines the above processes, provides flexible ownership models (choose between digital and physical), and provides more liquidity (online verified marketplace of graded products, larger audience, interoperability)

As biased as I want to be, this isn’t groundbreaking. PSA’s parent company, Collectors Universe, also owns Goldin, a secondary marketplace for collectibles. Smart business move, as they are trying to own the lucrative industry post-primary sale.

So how does Courtyard compete today? Price

And in the future? (some of these are predictions)

Repacking: With the rip and ship trend sticking around, repacking is an interesting concept that blockchain can facilitate more in a more verifiable and transparent manner

Authentication and valuation: This sounds odd considering that the blockchain takes care of a lot of this. However, what if I literally wanted to sell my NFT portfolio right now? Could Courtyard be a trusted 3rd party that could accurately value my collection, repack it, and facilitate the sale of it? Selling my collection (which consists of some valuable NFTs, and many worthless ones) as a ‘pack’ could be more lucrative for me instead of painstakingly listing every NFT or accepting lowball offers, while writing 80% of them off as worthless. For collectors, they get the thrill of ripping a pack that is priced appropriately, while understanding that a large majority of the NFTs will be worthless (just like physical cards).

Phygital: With the direction the industry is going, any collectible can be tokenized and receive the same benefits of liquidity, authentication, and interoperability. The platform is starting with collectible trading cards, but will expand far beyond it.

Lastly, Courtyard is closing the gap for the actual brands that own the IP. Imagine what The Pokemon Company would do to have direct insights into their physical collector base. Would they reward certain collectors with special edition physical collectibles, or early access to their next game? They will be able to now if they want to.

I’m not sure what the business opportunity for Courtyard is here. Maybe the fact that Courtyard will have the physical addresses and can pass that along to the brand with consent?

Physical items onchain are just get started, and Courtyard is one company that is showing how they might come about 💪

Shoutout to S4mmy.eth for their thread on Courtyard’s drop that made me think more deeply about this topic

The Casino on Mars

Yesterday, Matt Huang (Managing Partner at Paradigm) published a great thought piece on crypto: The Casino on Mars.

The piece provides perspective and a 30,000 foot view of the space and the reality that a lot of the space today is focused on speculation. However, that speculation is part of the bootstrapping process, much like settling on a new planet or the Gold Rush that put San Francisco on the map.

I recommend you read it. And if you’re tired of reading because you read my long-winded ramblings, skip the next piece from me and read this instead.

From a pensive POV, it’s healthy to think about what we’re doing here on the planet that is crypto. Whether it’s building, speculating, or creating, it’s all part of the process and hopefully there is a healthy balance of each.

For this publication, I’m sitting in one of these buildings documenting the interesting things happening when I look out the window. I hope you share some of that excitement while peering outside the window with me.

I’m heading off to my bachelor party tomorrow morning, hope I come back in one piece 😂

See you next week!

Have fun on your bachelor's! :D

So much promise for hoarding unopened packs