#253: Blur's Season 2 Airdrop Strategy

🎁 The airdrop may be divisive, but the mechanics shouldn't be ignored

It looks like airdrop season is starting to ramp up again and Blur, one of the main players that disrupted the NFT marketplace landscape over the past year, is back again just in time for Christmas.

What’s the TLDR?

Blur’s Season 2 concluded yesterday, lasting over 9 months (February 14 - November 20)

Pacman announced Blast, a Layer 2 blockchain that provides native yield (you can earn by holding Ethereum or stablecoins on the Blast blockchain). Blast has also raised $20M in funding.

Blur Season 3 kicked off, along with Blast’s airdrop program and timeline

Today’s piece will focus on Blur’s Season 2 airdrop mechanics and will touch on how Blast’s airdrop campaign is tied into it as well. If you want to dig in further on Blast, check out Blast’s website or check out Zeneca’s insights on Blast here.

And if this is the first time you’ve heard about Blur and its airdrop, I encourage you to read my piece on Blur’s Season 1 airdrop from last year. This is starting to feel like a movie franchise, like Fast and Furious getting to Fast X 😂

The conclusion of Blur Season 2

For those who have been active in the Blur ecosystem, the conclusion of Season 2 meant 1 thing: another airdrop!

No one knew exactly what it would look like, but many market participants were excited at the prospect of another crypto version of a stimmy check. Users were directed to Blur’s dedicated airdrop site to claim their hard-earned tokens.

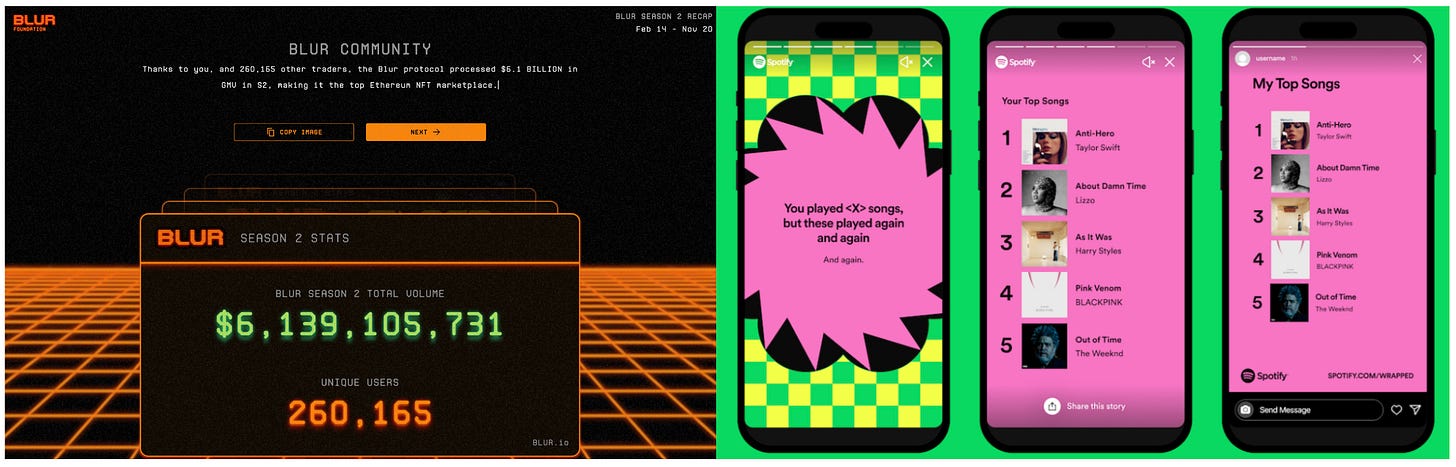

Visitors are welcomed with a recap sequence which reminded me a crypto version of Spotify Wrapped:

The Blur Season 2 recap shows the user’s Season 2 buy and sell volume, total marketplace volume and number of participants. Blur also used the recap as an opportunity to highlight their accomplishments including Blend (Blur’s NFT lending protocol).

After going through some stats, Blur switched gears back to the user and the points they accumulated in Season 2. The points earned throughout the season determined the number of airdrop crates the user received and their loyalty (how much the user used Blur vs. other marketplaces like OpenSea) determined the rarity distribution of the crates. Higher loyalty = better rarity distribution.

After another animation sequence, it’s finally time!

Whew, what a ride. After spending months buying, selling, bidding, and lending on Blur, users got to claim their airdrop! 😮💨

But when one season ends, another begins. And the Blur team took it to another level with…

Blur Season 3

Season 3 kept many of the same elements as Season 2: You can earn points by listing, bidding, and lending, which were actions that earned points. However, there was one big twist: $BLUR holders could also earn points by holding the token.

So instead of immediately selling the airdrop you received, the typical behavior of after receiving an airdrop, recipients are incentivized to hold. This reduced the selling pressure of the token while helping Blur maintain relevancy and attention for a longer period of time.

The $BLUR claimed from the Season 2 airdrop is automatically held by Blur here, with the option to withdraw or deposit. As I mentioned earlier, the typical instinct is to sell, but when you see something like this, it gets a lot harder to.

What’s going on here?

Not only do you earn $BLUR for season 3 by holding the token, you can also earn ‘Redacted’ from Blast, the Layer 2 chain that is being built. The way I think about this is incentives are being cross-pollinated. Not the same, but sorta like those loyalty partnerships from different ecosystems such as Delta x Airbnb (earn 1 mile on Delta for every $1 you spend on Airbnb).

The holder score is a BIG NUMBER. Not only that, but it goes up every second. Number go up feels good. BIG number go up feels really good.

The base variable is Holder Points, broken down into hourly points earned, which is also a big number

There is a multiplier to your Holder Points, with Season 2 participants starting at 2x (otherwise it starts at 1x). The multiplier increases by 0.5x per month once you make your first deposit. If you withdraw, your multiplier will decrease proportionally to the amount you've withdrawn. The lowest amount the multiplier can be is 1x.

There is an additional incentive to hold onto your $BLUR — There is a points schedule that acts as an additional multiplier in the first week after the Season 2 airdrop. Each $BLUR held earns 4 points per hour and gradually decreases to 1 point per hour.

What does this remind me of?

Yup. Slot machines have evolved in a way that has incorporated various mechanics that maximize dopamine and entertainment among other things:

Multipliers

Progressive jackpots

Max bet bonuses

Mini-games

Lots of big numbers and flashy graphics

Today’s piece is brought to you by Atomic Form. I wrote a piece on the company last week highlighting what they’re doing to elevate the digital art space, check it out!

Atomic Form sells physical displays and partners with some of the largest names in the digital art space, such as NFT Now’s Gateway Miami event at Art Basel next month. If you’re wondering why the art looks so good, Atomic Form might have a part in that. Use the code TPAN2023 to get 20% off your purchase 😉

Takeaways from Blur Season 2

There has been a wide range of opinions on Blur, Blast, and the incentive mechanics that have been incorporated.

My takeaways are less about whether this is good or bad, but rather understanding where this is going and newer tactics that may appear in the future from other companies, products, and platforms that incorporate a token and/or airdrop:

Utilizing the token-claiming experience as a marketing opportunity: This is a high-leverage moment where you can influence users to do (almost) anything. Take a quiz, share a piece of content on social platforms, read through a boring whitepaper, introduce your next product.

The gamification of everything: Airdrops have become increasingly gamified and include multiple layers and more options to continue playing. With Blur, the game continues into its third Season, provides a way to passively participate (holding), and introduces a new ‘game’ in the form of Blast. For the critics, this is less of a game and more of a ponzi. For others, it’s a creative way to incorporate engagement, retention, and growth loops.

Post-Airdrop incentives: The path, quests, and journeys to qualify for airdrops have become increasingly complex, long, and robust. However, there is still green space after the airdrop event itself. Why would your average airdrop recipient want to continue holding the token, especially if their goal is financially driven? Playbooks for the ‘post-airdrop’ period are being written, with Blur’s Season 3 contributing a page as an example of what can be done.

The bigger question IMO is how do you move past purely financial incentives to bringing value to users, the ecosystem, and the broader space. We see this with Friend Tech as well, with active users and new users decreasing significantly (I’m still using it though!) Hamsters love running on the wheel, but for how long?

Based on what we know, what’s next for Blur and Blast?

Blast Mainnet launched February 2024

Blur Season 3 will conclude May 2024, likely resulting in another airdrop

Blast airdrop will be distributed May 2024

The hamster wheel continues!

Thursday is Thanksgiving in the US, so I’ll be taking a break and resume writing next week. For those celebrating, I hope you enjoy time with family, friends, and food! Whether you celebrate or not, please take some time to reflect on things to be grateful for. Maybe you’ll be grateful for receiving one less piece from me this week 😉

See you next week!

Not a big fan of Blast myself so far, especially when you can get 20% yield on LPs instead, but Pacman deserves praise for knowing how to keep finding new bait to dangle in front of hungry influencers/traders. Let's hope the smaller fish don't get eaten by the bigger once again.