#263: Programmatic Whitelists with GLHF

PLUS: 🗣️ Franklin Templeton engages the crypto community on X

Programmatic Whitelists with GLHF

Once upon a time in web3 (circa 2021), minting NFTs was a free for all. New projects popped up, hyped up the mint, and thousands of users frantically attempted to mint, in hopes of reselling the jpeg for more than it cost.

As a result, these spikes in activity caused gas (the cost to put the transaction on the blockchain) to spike as well on the Ethereum blockchain. A helpful visualization of this concept using onchain data is tx.town, showing people (transactions) waiting in line to get on the bus (blocks on the blockchain).

Not too bad right? There aren’t too many people queuing up, and the buses are moving along.

Below the fold of the website though…😳

This isn’t the end of the world, but too many transactions waiting to get on the bus or too many unexpected spikes in gas due to these NFT mints isn’t encouraging for an onchain future.

This is also why Layer 2s and other blockchains with higher throughput and lower gas fees are important. That won’t be the focus of this piece though.

The emergence of whitelists/allowlists

The general NFT ecosystem didn’t mind too much since the NFT ecosystem was still early and despite the high gas costs (on top of the cost of the mint itself), these efforts were largely profitable for flippers.

Over time, it became clear this public minting strategy was going to create larger issues:

Gas spikes were getting worse as NFTs became more popular

New projects that were building for the long-term wanted to find a better way to cultivate a stronger community from the start. Public mints had too many opportunists focused on making a quick buck.

Bots were becoming a popular tool and exacerbated the above points

To address these issues, raffle platforms like Premint, Alphabot, and Subber popped up. These platforms helped project teams facilitate the process of determining who would be eligible to mint a project by creating a mix of onchain and offchain criteria.

This concept isn’t novel. An example of whitelisting exists in the ticketing space, such as Ticketmaster’s partnership with Chase cardholders.

Several months ago, I was eligible to register for a chance to purchase tickets to see Olivia Rodrigo in August 2024, and was ‘whitelisted’ to the Harlem Globetrotters presale because I had a special code.

Great — gas wars have been averted for the most part, and the space has better tools to determine who should be eligible to mint a project. Problem solved, right?

Just ok is not ok

There isn’t anything inherently wrong with the existing whitelisting process. However, this is a ‘just ok is not ok’ scenario, coined by the AT&T ad campaign from a few years back. The ads are entertaining and make a great point that ‘ok’ works for many things in life, but not for everything.

With the concept of whitelists, this logic follows. The process is a big step up from the infamous gas war era, but just ok is not ok. And there is a new project that is exploring what a better whitelisting process could look like.

Dith introduces GLHF

What is GLHF? First of all, it’s a gaming acronym that stands for ‘good luck, have fun’. The PFP project is inspired by 90s gaming era and founded by Dith (Head of BD at Proof of Play, a web3 gaming studio).

As usual, when I hear about a new interesting project I immediately join the Discord, get early roles in the hopes that it increases the chance of a whitelist opportunity, apply for the whitelist raffle, and send a few ‘gm’ messages in the chat. Typical behavior.

What caught my eye was that later in the day, Dith shared more details about how GLHF was doing things differently as it pertained to the WL process with a programmatic WL.

How does it work?

The GLHF pre-determined the WL criteria and assigned points and weight for each criteria

Criteria could be revealed or kept private. The GLHF team decided to keep the criteria private.

Selecting WL recipients should be based on existing behaviors and signals, ideally leading to better long-term outcomes.

This approach addresses some of the ‘just ok is not ok’ tensions between teams and their respective communities hoping for access to a lucrative mint:

This isn’t a comprehensive list and there are plenty of exceptions to this norm. However, we see the clear tensions between these two parties. And that’s what GLHF is looking to improve with their experimental programmatic WL concept.

So a day later, what happened?

What sticks out isn’t the 10,000 submissions (that’s a shit ton lol), but rather that ‘750 or so people meet the criteria to get WL’. Why?

This is programmatic with preset criteria. There’s no ‘Oh no! We forgot to include the Bored Ape community, can we fit them in? 😅’ Anyone is welcome to apply for WL.

This number is a helpful feedback loop to the team. If the number of wallets that met the WL criteria were lower than expected, the team could hypothetically adjust the knobs on the backend. It doesn’t seem like that happened, but it could be helpful in certain cases.

The operational efficiencies are apparent as well:

And Dith made my diagram’s point clear with this post:

GLHF reveals their criteria

Before we get into the details, note that users had to connect other apps to the WL bot, which helps provide more information on the user.

Yesterday, GLHF shared the results of their programmatic WL experiment and the qualifying criteria. Because GLHF was a gaming-focused PFP project, the team wanted to focus on giving a WL to long-time gamers, not those who play only to earn and sell items.

The team didn’t look at wallet data since many use burner wallets to mint. The team also didn’t look at the connected Steam account data because many don’t set their profile to public

So what did the team check?

Discord account age: Prior to 2020, Discord was mainly for gaming. If you were here prior to Discord becoming popular for other use cases like crypto and web3.

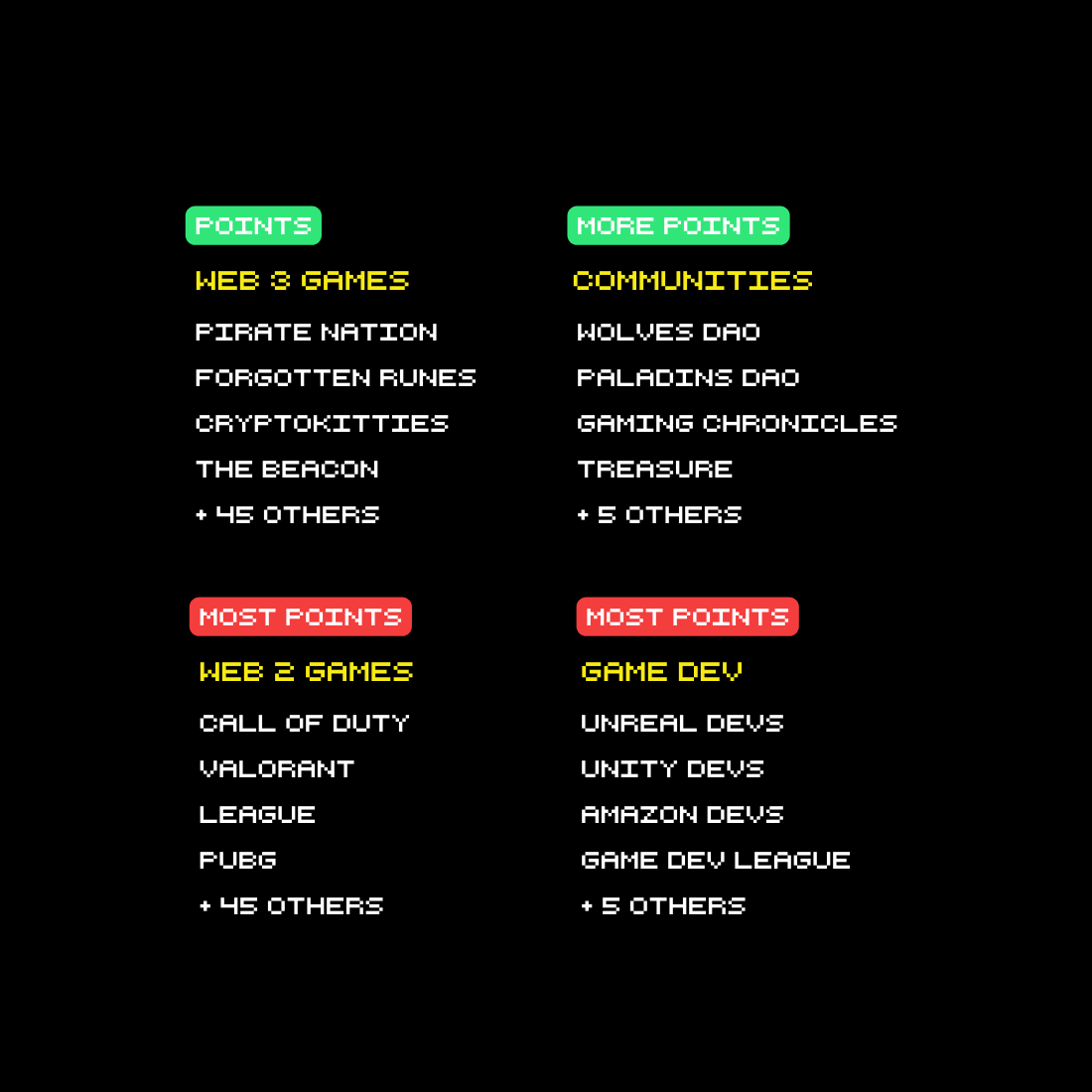

Discord servers: Real gamers hang out in specific servers, with different categories earning more points

Connected accounts: Lastly, the team looked at gaming platform accounts that were connected to the Discord account, like Steam, Battlenet, Xbox, Playstation, Twitch, and others. There was an additional check for accounts that scored highly on this criteria since this could be more easily gamed.

Putting it all together, the GLHF team gave a WL to the top 1,500 highest-scoring wallets out of the 15,000 submissions.

Since the total supply is 3,690 the remaining supply was given to holders of some web3 gaming collections, showing that the programmatic WL concept can be a complement, not just a substitute.

And as for me?

Well…I’m not a gamer, so I unfortunately didn’t make the list. And that’s a good thing, because it means the programmatic approach worked! My loss is a real gamer’s gain, and that’s the point.

I’m hope GLHF’s programmatic WL becomes a tool that is adopted by other teams to help create stronger communities from the get-go. The more creative and thoughtful the criteria are, the higher the likelihood of success of the programmatic strategy.

If anything, the phrase GLHF has a lot more meaning to it 🎮

Another fund manager joins in on the X fun

A couple months ago, I wrote a piece on memes and highlighted VanEck, a fund manager that has embraced X as a channel for memes and engaging the crypto community.

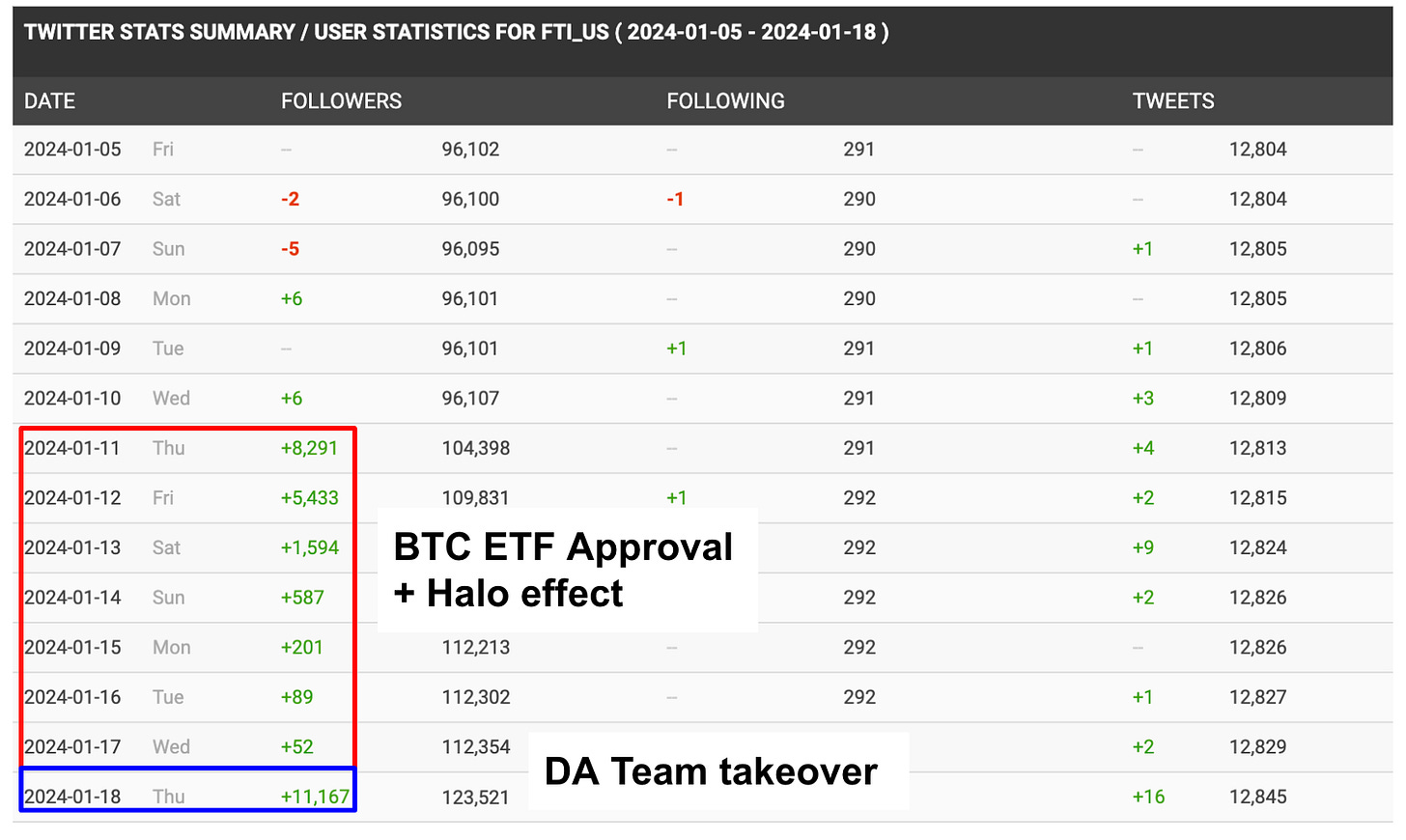

The strategy has proven fruitful for the company (and entertaining for me), especially leading up to the Bitcoin ETF approval in the US.

There’s a new fund manager that has come to play, and they manage $1.4 trillion: Franklin Templeton. They’re serious about it too, putting laser eyes on their Ben Franklin PFP once the ETF was approved:

Sure, there are obvious reasons why this post went viral. Having 127k followers makes it much easier too. That said, this is the ballpark of engagement that the account had before the Bitcoin news.

So what did Franklin Templeton do yesterday that caused a commotion? Some team members from the Digital Assets Research Team took over the X account and started speaking the language of crypto and web3 degens:

Ultimately, this cameo was an effort to promote Franklin Templeton’s Digital Assets account, while benefitting the parent account too.

This type of strategy isn’t exactly new, but it’s been a while since it’s been utilized by established brands. Jason Yanowitz from The Block sums it up well:

See you next week!

Damn I'm so sad I missed GLHF. I need to spend more time in the trenches...

Great read overall, I've thoroughly enjoyed this one!