#349: 2024 Developer Report, Why Stablecoins Will Eat Payments

🐧 PLUS: Pudgy Penguin lore and why is everyone changing their PFP to a Pudgy

2024 Developer Report

Christmas has come early for those who love reports!

Electric Capital released their 6th annual Developer Report, highlighting the latest and greatest about developers in the industry.

The 218 slide report is worth reading, but if you don’t have the time Maria Shen has a great thread on key insights and figures.

Some of the highlights:

There are 23,613 monthly active developers as of November 2024 with a 39% annualized developer growth rate since 2015 when Ethereum launched

Established developers (2+ years) in crypto grew 27% YoY, while developers with shorter tenures fell. Overall this is a healthy sign from a retention POV

Asia is the #1 continent in crypto developer share, and North America dropped to #3

The US is the top country by developer share with 19% and has steadily dropped every year from 38% in 2015

India onboarded the most new crypto

Ethereum is the top ecosystem by developer share and Solana is #2

Solana is the top ecosystem for new developers

1 in 3 developers work on multiple chains, and 74% of them work on at least one chain that runs on EVM (Ethereum Virtual Machine)

Despite the common trope that NFTs are dead, NFT activity is reaching new milestones

There were over 130k+ NFT deployments in November 2024, an all-time high

300k+ wallets trade NFTs per month

Base is the dominant NFT ecosystem, with 97% of mint volume occurring there

$196B of stablecoins are in circulation (and growing by the day!) and $81B in volume are transacted per day

There’s the saying that attention is the scarcest resource, but as I’ve spent more time in this space I tend to disagree. I believe that developers are the scarcest resource, as they’re the ones who create the products that drive and suck up attention.

These stats are encouraging, and I expect these numbers to increase significantly next year as crypto continues to pierce the mainstream veil. Cheers, developers! 🥂

How stablecoins will eat payments

When my friends ask me why crypto is useful and interesting, my go-to example these days is stablecoins, which IMO is the clearest example of product market fit, especially for those in developing countries.

The argument for stablecoins is simpler and clearer. They can act as a hedge against inflation, a more efficient way to transact in terms of speed and cost, and are widely accessible.

Sam Broner from a16z provides more insight on stablecoins and why they’ll eventually transform the world of payments.

If you're based in the US, I'm sure you've been to a restaurant with signs of "cash only", or they provide a discount for paying in cash. In fact, yesterday night I grabbed pho with my wife and I received a 3% discount for paying in cash. (tbh the real reason was they were about to close and explicitly asked for me to pay in cash lol. still got the discount though!). This type of discount happens at gas stations as well, often providing 10 cents off per gallon if you pay with cash or debit.

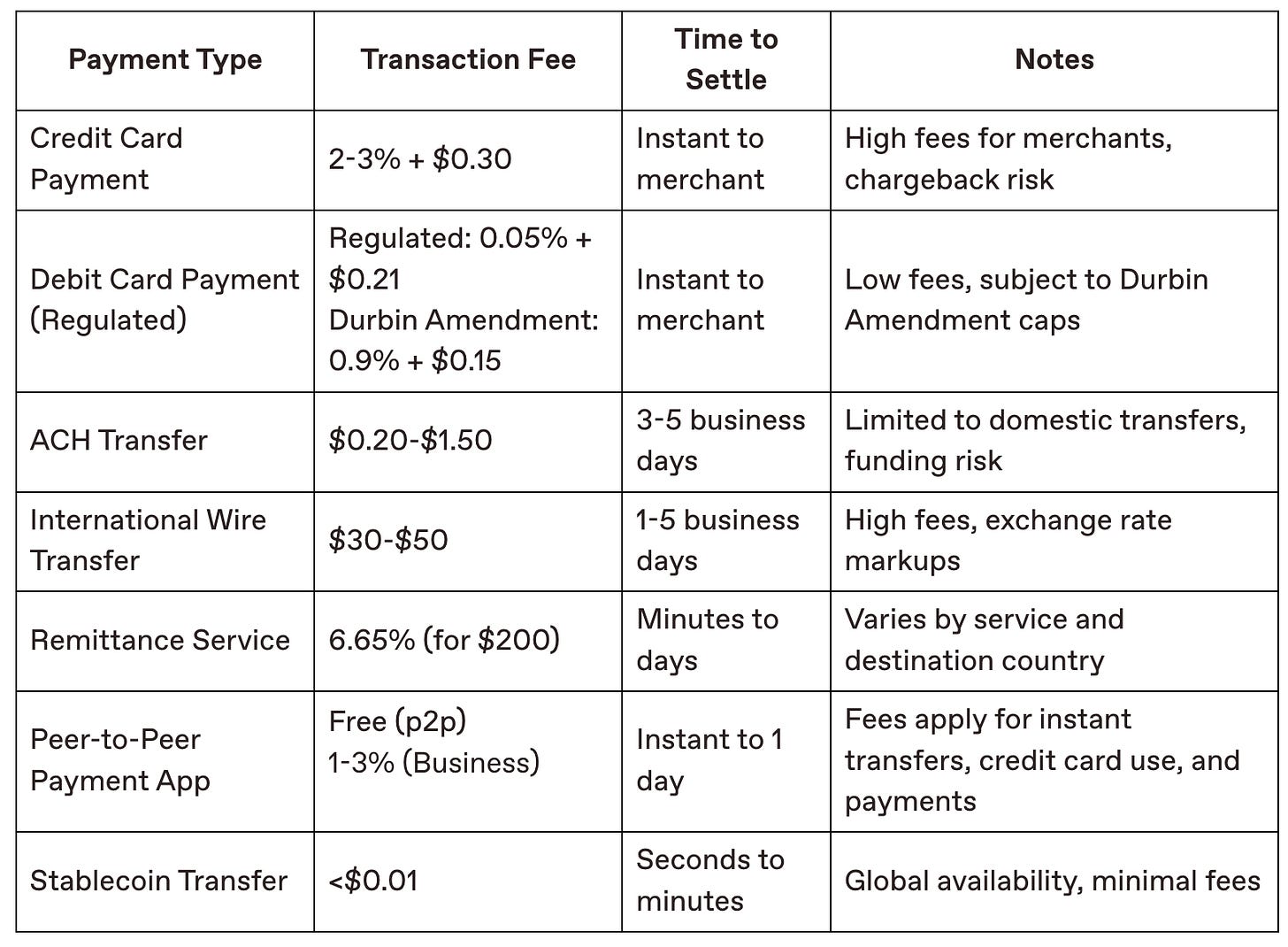

Sam makes the case for stablecoins when comparing the fees between different payment methods. For small or international merchants, it’s a no-brainer.

That said, broader adoption of stablecoin payments by larger retailers in developed countries is a different story since adoption comes from both sides of the marketplace: the merchants and consumers.

And for consumers who have premium credit cards, the incentives are juicy. I pay $550 a year for my Chase Sapphire Reserve credit card, but I get $300 in travel credit, $300 in Doordash credit and Dashpass, airport lounge access, rental car insurance, travel protection, purchase protection, additional points if I book through the Chase portal, and many other benefits.

For now, stablecoins are a perfect solution for those view them as a necessity, but aren’t as attractive for those where it’s an option.

As stablecoins pick the low-hanging fruit, they will eventually reach higher up the tree towards the fruit that has had more time to ripen and grow even juicier (aka ppl like me, juicy! 🍑)

We’re seeing early versions of these incentives appear like Coinbase’s version of ‘native yield’. Hold USDC on Coinbase? Earn 4.35% in rewards.

And there are payment cards like Gnosis Pay and Cypher which let you spend your crypto like cash. Or the Gemini credit card, which gives you cash back in the form of crypto.

In the future, startups operating in the stablecoin space will expand the incentive and perk networks to become a more appealing payment option for those who don’t need to transact in stablecoins, just as credit cards started layering on perk after benefit after point multiplier over the past decade.

Promoting PENGU through lore and PFPs

As the anticipation around Pudgy Penguin’s PENGU token launch reaches a fever pitch, the team continues to provide a great case study of how they’re staying top of mind.

Pudgy Lore

On top of the bull posts, one tactic that the team has employed this week is sharing Pudgy lore.

For example, yesterday pp shared the history of the Pudgy Rogs (yes, rogs), one of the NFT collections in the Pudgy Penguins ecosystem.

TLDR:

August 2021: Pudgy Penguins holders were gifted “PudgyPresent” NFTs. These animated eggs stayed that way for months

Christmas 2021: The eggs hatched and revealed inanimate fishing rods, misspelled as ‘Rogs’. Naturally, the community went into chaos, upset at the reveal and confused at WTF the purpose of these rogs were

Luca shares “with 99.999% certainty” that if the rogs didn’t hatch from the eggs, he wouldn’t have purchased the Pudgy Penguins

Today, Berko shared a thread of Pudgy Penguin songs, often played during Inner Igloos or X Spaces.

And earlier this week Agents shared a screenshot of the Discord message that marked the beginning of the turnaround for the collection that brought it to where it is today. No further context, IYKYK.

These posts are simple, engaging, and contextually educational. For holders who experienced all this, these posts serve as reminders of why they are here today, through the good times and bad.

For newer holders and those who are starting to learn more about PENGU, they get to learn about the lore behind some of the pivotal moments over the past 3+ years. Although they didn’t experience these moments firsthand, they are fed the story in an easy to consume way while increasing emotional buy-in.

This tactic can certainly be replicated by other NFT communities and even non-NFT ones with a strong culture.

Pudgified PFPs

In my PENGU piece, I shared that products with large mainstream audiences and reach such as Phantom and Moonshot posted a branded version of their Pudgy, and we’re seeing even more of them now:

Xai (changed PFP): Gaming focused blockchain

Quai Network (posted branded Pudgy): Blockchain

Myriad (changed PFP): Media engagement platform which I covered a few months ago

OpenSea (changed PFP): NFT trading platform

Anatoly (changed PFP): Solana co-founder

TravelSwap (changed PFP): Travel platform that accepts crypto

And let’s not forget VanEck, possibly the first brand to make the PFP change 6 months before the other cool kids jumped on the bandwagon.

So why are these brands/platforms doing this? It certainly isn’t worth the short-lived engagement to make a wholesale PFP change.

My gut tells me these companies and their respective communities will be recipients of the PENGU airdrop, so they have mutually aligned incentives to indirectly promote it through other avenues. Indirectly because details around the airdrop are still intentionally sparse, leaning into the surprise and delight approach.

Co-marketing still largely consists of the “WE’RE EXCITED TO ANNOUNCE THAT COMPANY A 🤝 COMPANY B!!!” type of announcement. Nothing wrong with that, but the Pudgy team is taking an approach that leverages their strengths — PFPs.

See you next week!

Really good issue!