I mentioned there may be some headlines regarding Yuga’s Otherside land mint. Who doesn’t love clickbaity titles?!

A quick Google search for ‘Bored Ape Yacht Club’ shows this:

So what the hell happened? Let’s break it down.

And if you didn’t read my post from last Friday, consider reading that first for some additional context.

The Intro

On Friday evening, NFT users noticed that Opensea was accepting a new token on its platform, $APE (Yuga’s token for the ecosystem it is building).

With this tweet, the hype frenzy going into the Yuga’s Saturday land sale officially began.

Opensea has 1.6M Twitter followers btw.

What does this mean?

When Opensea allows for purchases and sales to occur in a specific token, this allows the opportunity for additional adoption of said token.

As for $APE, this is particularly interesting because it is primarily used in Yuga’s ecosystem. This tweet sums it up quite well.

The potential for $APE distribution and cross-pollination of communities is strengthened with this additional vector for entry into the $APE ecosystem.

And did projects follow suit as Jonah predicted? Only time will tell with the real impact, but projects reacted quickly.

This is exactly what $DOGE does but in a more diluted fashion.

And Opensea made sure every user knew what was going to be happening this weekend.

They even sent an e-mail, which is not something they normally do, especially for a specific NFT project.

The NFT space was crackling with energy like kids on Christmas Eve.

The Drop

Before getting into the details, can we take a couple minutes to admire the Otherside website?

Kudos to the team and partners for developing this beautiful site!

But this post is not about the site. It’s about the sale. And the sale was insane.

In order to participate you needed:

A KYC’ed wallet (meaning you had to have a verified identity via driver’s license or passport)

At least 305 $APE ($5800 at the time of the sale), or 610 ($11,600) if you wanted to purchase 2

Enough ETH for gas (a fee required to have your purchase be confirmed on the Ethereum blockchain)

If you’re a first time NFT purchaser, this is not easy. Even if you’re experienced, this is still a multi-step process. Not to mention if you forgot to complete the KYC step weeks ago, you were out of luck for participating in the mint.

Because of the KYC requirement, there was a lot of side chatter around purchasing KYC’ed wallets, and word on the street was they were going for 1 ETH ($2800) or more. Just to get access to the mint.

(Purchasing KYC’ed wallets from someone you don’t know is a very risky situation, so I would strongly discourage this.)

So what HAPPENED during the sale?

The sale itself broke records (16.67M $APE or ~$300M) and quite literally broke the Ethereum blockchain due to all the congestion caused by the demand.

This congestion of users that wanted to mint/purchase the land at the same time caused a spike in gas. And when I mean spike, I mean unprecedented levels.

If you’d like to learn more about gas, check out the explanation here. I may have a separate post in the future with poorly drawn but friendly visuals :)

So what did this mean in terms of dollars and cents?

If you wanted to do anything on Ethereum while the land sale was underway, it would cost thousands of dollars. It typically costs a lot less, think $5-$30.

And this is how much it cost me to PURCHASE my 2 lands, not including the $APE cost.

And understandably, people weren’t happy about it. These are all BAYC owners too!

In short, Yuga Labs significantly underestimated the demand for the land sale.

Here’s their response:

TLDR: Our bad, we underestimated the demand, we might create our own blockchain for future efforts 👀

The community response to this was largely negative. The response was viewed as tone deaf and there has been speculation that the sale conducted in this manner was done intentionally so they could announce that they would create their own blockchain.

However, within the next 24 hours the focus turned to the reveal of the land.

The Aftermath

In true Yuga fashion, more records were broken. The pace of sales was blistering as unrevealed plots traded at 7 ETH ($20,000) out the gate.

And once these lands revealed on Sunday, having a Koda made all the difference.

Wtf is that…thing? Er, Koda?

Well it’s a $70,000 (25 ETH) ‘thing’. And depending on the land that critter is on, it could be worth a lot more. There have been multiple 100+ ETH sales depending on the land and its corresponding traits.

And less than 24 hours after the sale concluded, the all-time transaction volume for Otherdeeds zoomed past Moonbirds, which broke records 2 weeks ago.

And at the time of this writing, Otherside is now closing in on $500 million in transactional volume, just on Opensea.

Does all that promotion that Opensea make a little more sense now? They make 2.5% on all that volume, so ~$12.5 million so far. Off of one project. Ah that $13.3B valuation makes a little more sense now…

Some other stats:

What’s Next + Takeaways?

No one outside of Yuga Labs really knows what is in store for Otherside and these land plots. However, doing some sleuthing around the Otherside website yields some clues.

The sale sucked: No other way to put it. It was expensive, left a lot of people in the dust, and was executed poorly. This is arguably the first blemish on Yuga’s otherwise flawless resume. However, this space will continue to act as it always has — With a memory of a goldfish. This week, more news from other projects will take over the news and hype cycle, and many will forget about the epic gas wars of April 30th, 2022.

Yuga could have done a better job structuring the mint, but the reality of the space is that the current infrastructure cannot support mass market demand yet.

There are still a lot of unknowns with the Otherside land: What does a Koda do? What does an artifact do? What if your land has no resources? No one knows yet.

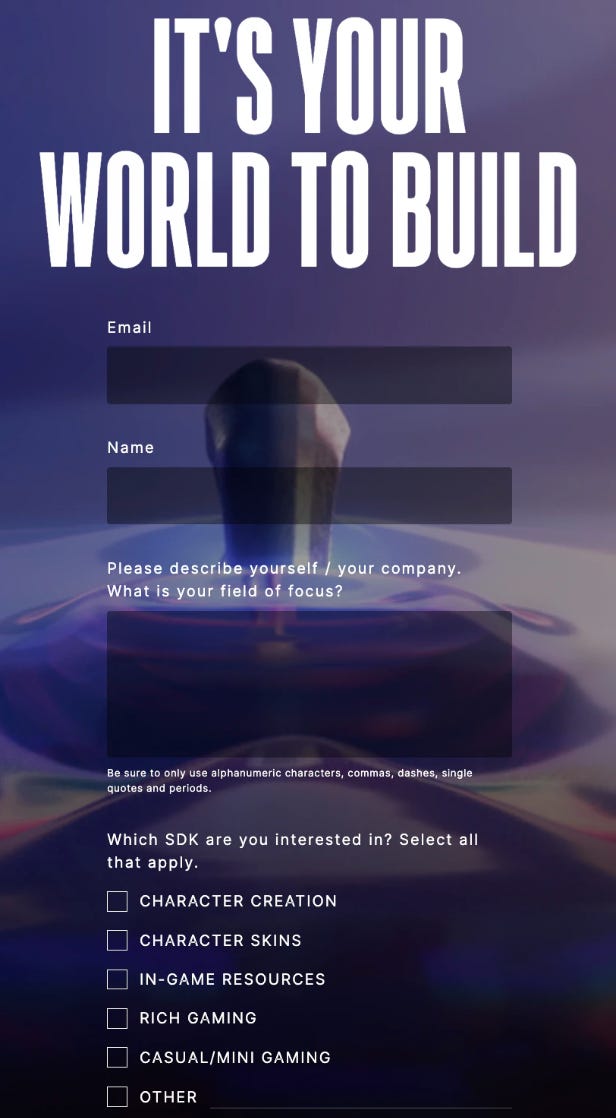

There’s a SDK coming: The land itself is just a part of the broader ecosystem that Yuga wants to build. But they also want others to help build out the Yugaverse as well.

Yuga is already working with strategic partners: One name in particular I have not seen before is Improbable.

In short, they allow for rich immersive experiences that enable thousands of users to interact concurrently, like this.

And they released a casual blog post over the weekend, and this caught my eye.

Those are some prettyyyyy big statements.

I’m looking forward to seeing what comes next and keeping y’all updated. But for now, on to the next crazy mint!