[Dive #173] What is the Value of a Brand?

PLUS: 🦸♂️ Explaining blockchains with superheroes

One more thing about Dookey Dash

…and I’ll shut up for at least a week — I came across a helpful website that summarizes some key stats for non-technical folks, Dookey Stats.

Updating some of the stats I reported on previously:

Token Utilization Rate: 96% (25,525 sewer passes played out of 26,485 minted)

Total APE spent on in-game boosts: 401,368 (~$2.5 million)

# of top 500 scores that were Tier 4 passes: 489, 98% (higher tiered passes = higher point boost)

Mongraal, the pro gamer I featured in my last piece, had 27 passes and held first and second place in the leaderboard. His lowest ranked is at 174. A true pro.

Now we wait for the scores to be validated and the announcements for the next phase of the Sewer Pass mint.

Measuring brand value with NFTs

As NFT brands have raised capital over the past couple of years, the distinction of owning a NFT does not mean you own the company has become more clear.

Community members of specific brands/collections have been empowered to be more vocal about their opinions, whether it’s praising or criticizing the decisions the team makes.

There have been treasury and DAO-like structures that allow for certain elements to be decided upon by the community (eg: Doodles’ Doodlebank or RugDAO), but the core decisions are left to the company and team to make.

I’ve pondered about this concept in the back of my head for the past few months. If it isn’t ownership of the company, what is it?

Holding a NFT is not ownership in the company, but rather ownership in the BRAND of the company.

Before I make the case for this, let’s look at how brand value is measure today.

The most valuable brands of 2022

Last month, I came across this article from Visual Capitalist. This was the catalyst that made me dig up the old topic buried under all the other potential topics to write about.

The animated graphic visualized the top 10 brands from 2000 to 2022. This is the top 10 from 2022:

It’s no surprise looking at this list. These are globally recognized brands and have all have some form of diehard fanbase.

Some examples of how brand value shows up:

Tattoos (Harley Davidson)

Limited Time promotions prompting a dedicated customer base to purchase (McDonald’s)

Merch, especially limited edition merch (Starbucks)

Looking at the same chart that Visual Capitalist provided, what does the brand value look like as a percentage of the market cap (value) of the company itself?

Notes on the above:

The brand valuations are based on 2022 metrics, while the market cap of these companies is based on today’s numbers, so the true brand value as % of market cap is likely lower

The Mercedes number is a high outlier so I’m either 1) pulling the wrong market cap metric, 2) the brand value is overstated, or 3) Mercedes has a ridiculously strong brand

That said, the point I’m making is that the concept of brand value is a material part of the company’s value itself. Once the company reaches a certain point the name, likeness, and image of the brand itself holds value.

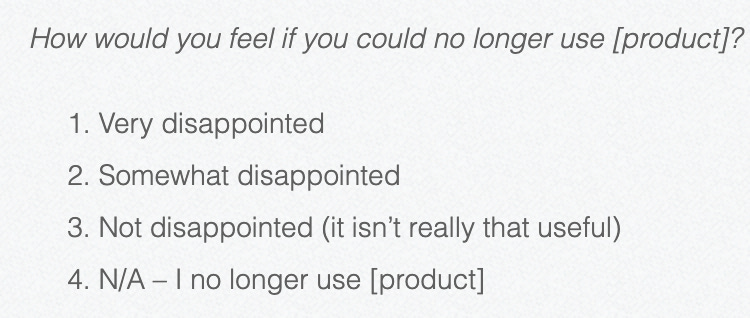

In the disciplines of product and growth, Sean Ellis (an OG growth guru) created the Product Market Fit survey that has been adopted by many startups. This question is asked to the users:

If the number is >40%, you have product market fit, woohoo! You can’t quantify the value, but you can show there is value.

My version of this (that I’m making up on the spot 😂) is if brand X were to go bankrupt tomorrow, how much would you donate to make sure that X doesn’t go under?

In the case of a company like Apple, I imagine that number would be pretty high.

How brand value is measured today

Let’s go back to that list of most of valuable brands. How is that metric measured?

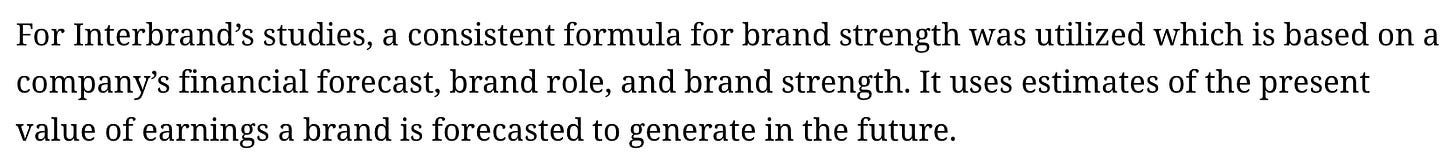

The Visual Capitalist stats came from an Interbrand report, a global branding consultancy, and this was their methodology:

When you look at the concept of brand value from an accounting perspective, we can see it’s also a bit hand-wavy:

When we hear about a company getting acquired for more than their stock price market cap is worth, one of the reasons of this is because of the goodwill tied to the company. This includes the company’s brand, loyal customer base, talent and proprietary tech.

This article also provides a great overview of the various methodologies to measure brand value:

Cost-based: How much does it cost to build the brand?

Market-based: What is the current market climate and sale price of similar brands?

Income-based: How much money does the company make?

Customer-based: Measure the lifetime value of current and future customers

Net Promoter Score (NPS): How likely customers are to promote the brand

Bringing it back to NFTs

Alright TPan, let’s get to the point.

Agreed. I’m setting the stage for my argument because I want to point out that the value of a brand is a mix of art and science. There are no exact formulas to measure what a brand is worth, so a variety of approaches have popped up to help triangulate it.

I believe that NFTs are another data point that can help measure brand value.

Specifically, NFT collections have a floor price and market caps, just like companies do.

For example the floor price of a Bored Ape is currently 78 ETH, or $120k. Multiply that by 10,000 and you get $1.2 billion. Is that the brand value for BAYC, which is one of several collections under Yuga Labs? Maybe…

Let’s take a more data-oriented approach.

Alright…these figures are all over. Doodles’ 20% is in line with the numbers we saw earlier. But Yuga’s brand value is 108% of the company’s valuation?! What’s going on?

Market timing: Yuga closed their fundraise prior to the crypto crash while Doodles raised during the depths of the bear market.

First mover advantage: There is generally a premium for first to market.

Valuations denominated in crypto: Yuga’s closed their fundraising during a time where ETH was still at a higher price point ($2,975) along with a stronger crypto market at the time compared to when Doodles raised ($1,575).

This highlights the nuance of measuring brand value for web3 consumer and how there is room for standardization in measurement.

It’s also possible that web3 native consumer companies lean more heavily on brand as a valuation metric. There are countless examples of how these companies have been built off the backs of the community members.

What needs to happen for NFTs to be a reliable brand value metric?

There’s a long way to go, but I still believe that NFT collections can be a reliable supplemental metric to measure of brand value. What needs to happen for that to be a reality?

Focusing on relative value, not absolute

As shown in the above comparison of Yuga vs. Doodles, looking at brand value on an absolute basis is unreliable. However, measuring relative movements in valuation are likely reliable, even today.

By emphasizing relative changes in floor prices and combining this with on-chain and off-chain sentiment, brand value or custom brand scores can be created in a formulaic, repeatable, and scalable way.

Removing speculation

NFT price movement is volatile. One piece of news can materially move the floor price of a collection.

To address this, a stabler measurement methodology needs to be incorporated, such as looking at trailing 30 day moving average instead of the floor price of a specific day.

Normalizing rare NFTs

NFTs are not fungible like a share of Apple stock is. Measuring the value of a NFT collection based on the lowest listed token doesn’t always make sense when you have sales like this.

Brand valuation models may need to account for subjective factors like rarity or aesthetic.

Creating different models for web3 native brands vs. web2 brands entering web3

What may be a reliable measurement model for BAYC, a web3 native brand, will not apply to Coca Cola launching a 10k digital collectible collection (if you’re reading Coca Cola, don’t do this plz).

Larger web2 consumer brands can still use their digital collectible collections as data points if done thoughtfully, but only as one component of a multi-dimensional approach.

Only collections that reach certain qualifications should employ this approach

Not everyone is qualified for this approach. There needs to be a set of factors that allow a brand to lean on their digital collections as another indicator of brand value. Some that immediately come to mind are:

Floor price

Time since launch

Holder distribution

I feel like there is a startup that can come out from this. Quick, someone build it before Nielson or Quantcast does!

See you next week 🙂