Alright students, what did we learn yesterday?

Wait…so if it’s evil why are so many people talking about it? Why are more and more people using it?

I think pretty much everyone can agree that not giving creators their due is a bad thing, as it counters many of the benefits that Web3 provides them.

However, that’s not all Sudoswap does. It’s not just a marketplace that has low fees and bypasses creator royalties, there’s more to this divisive platform.

For those of you that really want to dig in, here are the docs to Sudoswap. Also, here’s someone way smarter and technical than me explaining Sudoswap.

The simple definition of Sudoswap is what’s on their homepage:

So what makes Sudoswap a decentralized versus a marketplace like Opensea?

Don’t worry, we’ll break it down. I sorta have to, this flies over my head much of the time as well 😵💫

AMM = Automated Market Maker

AMM’s have existed in crypto prior to Sudoswap, some of the most popular ones being Sushiswap or Uniswap. You can trade or ‘swap’ your crypto into different crypto.

…Almost like if you’re traveling to another country and you need to exchange your native currency to the currency of the country that you’re visiting.

Holy crap. This airport currency exchange kiosk is making a KILLING. Based on the chart my guess is that this a British airport and the rates are for British Pounds. Anyway…

TLDR - AMMs use code (or formulas) to power trading of assets or tokens. In Sudoswap’s case, these tokens are NFTs!

Put into a chart:

Naturally, Coinbase and Opensea use code, but doesn’t solely run on code. They have a lot of humans that help facilitate many other operations or edge cases, so it’s less efficient (eg: don’t expect a speedy reply from Opensea support).

Great, I now know that Sudoswap is evil AND it’s more efficient since it’s an AMM.

Indeed. Let’s look at the buying experience on Opensea first. What are your options? Let’s stick with CloneX since that was the example yesterday.

The primary ways you can purchase a CloneX on Opensea is through purchasing at the listed price or by making an offer.

You can also filter for certain attributes and make specific offers for certain traits, if the collection allows for that capabilities. In this case, CloneX does. As we can see, someone is willing to pay significantly more than the 6.95 ETH floor for the “Awaken” Eye Color attribute.

So what can you do on Sudoswap?

I can purchase the NFTs outright, just like on Opensea.

Wait a second…why are they all priced the same at 6.907? Is that a bug or a scam?

Not quite. The logic that Sudoswap uses, similar to the other decentralized exchanges (DEX for short) is that they use the concept of pools. Each pool, whether you’re buying or selling has a programmed set of rules.

Here are the settings of that pool:

What does this mean?

Every time someone buys a CloneX from this pool, the floor price will increase by 4.2%

Every time someone sells a CloneX into this pool, the floor price will decrease by 4.2%

The creator of the pool (the ‘liquidity provider’) will earn 2.5% through the swap amount, similar to how those airport currency kiosks purchase currency at a lower price than they sell at.

This is in addition to the 0.5% Sudoswap platform fee.

So it’s dynamic. Pretty cool! As for the CloneX pools, there’s currently 109 of them. So what are all these other pools?

They’re basically the equivalent of an offer to purchase a CloneX for a ridiculously low price, so very similar to putting a lowball offer on Opensea. Hey, you never know...

So back to that pool pricing — Why are all the prices of the CloneX the same?

The pool treats each NFT purely as a token and disregards the traits and rarity of each CloneX. Similar to if you were withdrawing cash from the bank. You don’t care if you get a $100 bill that is crisp or is about to fall apart. A $100 bill is a $100 bill.

Ok, maybe I’ll take the crisp $100…Also Big Ben has a thick eyebrow. Was it always that thick?

Point is, don’t put your rare CloneX into that pool, it’ll get scooped up quick.

On top of the dynamic rule-based buying and selling and the cheaper cost of transacting on a platform like Sudoswap, what other interesting things are going on?

A Sudoswap Raffle Experiment

A smart friend of mine in the space who’s deep in Sudoswap shared with me this tweet a couple evenings ago.

A NFT raffle? You bet you bum that a lot of degens would jump on this like flies on a pile of 💩

So how does this lottery work, now that we understand the basics of Sudoswap?

You purchase raffle tickets

Price starts at 0.01 ETH

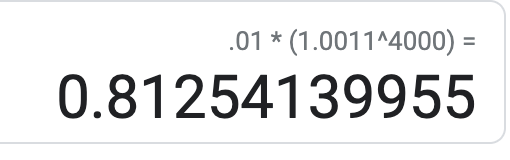

Exponential curve is 0.11%. So that means the second ticket will cost 0.01*1.0011. The third ticket will cost 0.01*1.0011^2, etc.

When there are a total of 4,000 tickets in circulation, the raffle will conclude and a winner will be chosen to win the prize pool

Until the raffle concludes, you can buy and sell with no fees

If and when the raffle concludes and executes, 10% of the prize will go to the developers

When you sell your raffle ticket back into the pool, that ticket NFT is burned and removed from circulation.

For the last point, it’s important to remember that the exponential curve that determines the price of the raffle ticket goes up and down depending on buy/sell pressure.

So the total number of tickets purchased can go over 4,000 because some of those raffle ticket holders can sell their ticket. It’s only when there are a total of 4,000 tickets in circulation the raffle will occur.

Confusing? Let’s use a real world example. Remember this?

Now, let’s imagine Mega Millions added some additional layers to their simple lotto structure.

Let’s say each successive lotto ticket purchased cost $1 more. Not only would you want to get in earlier for a shot at that jackpot, the jackpot would be wayyyyyy bigger. You could also sell your lotto ticket back to the liquor store at whatever the current price of the lotto tickets are. And the Mega Millions draw will only happen when specific parameters are hit.

Ok IRL example is getting a little crazy lol.

Also, the “developers” in this lotto is the IRS and they take way more than 10% 😂

Anyway, I think we all get how this works, this is basically the lotto on game theory steroids.

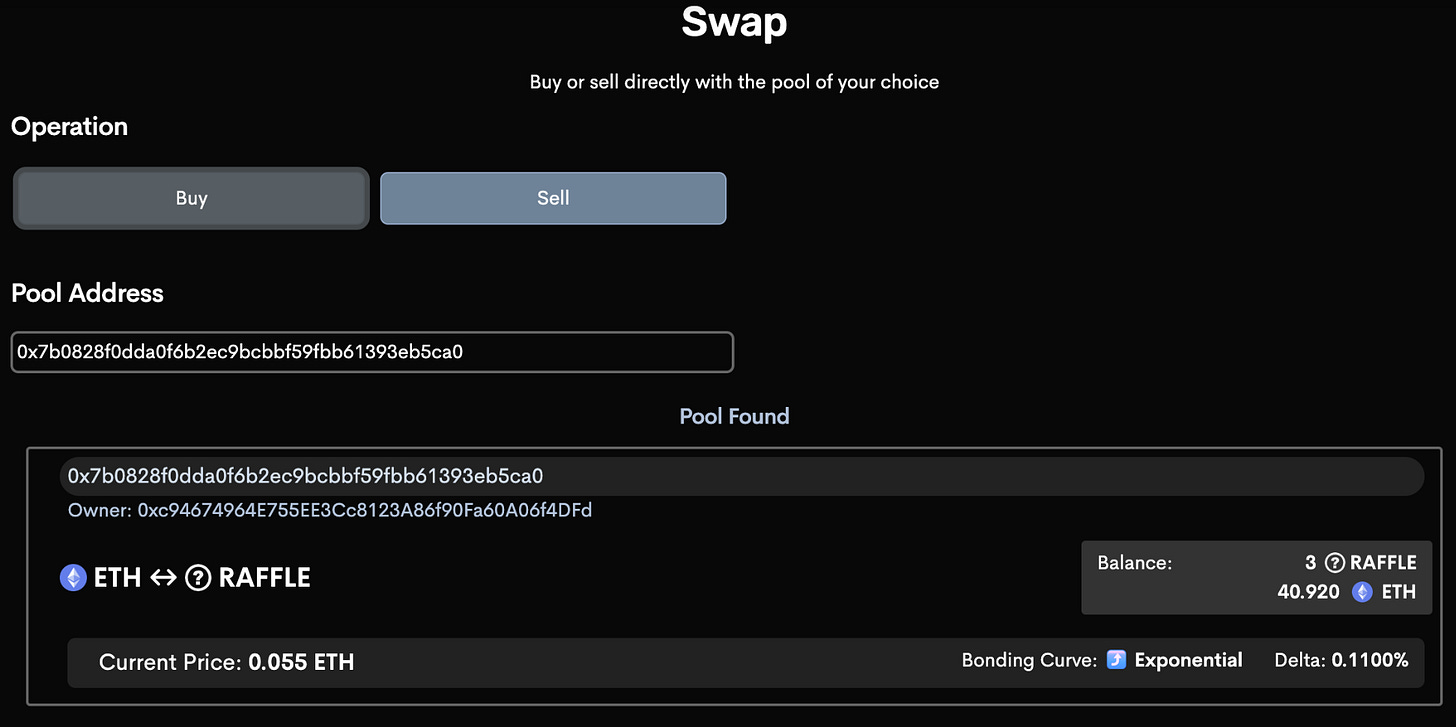

I was intrigued and I decided to poke in and observe the action:

8:46pm PST - The raffle was 40 minutes in and the party was getting started.

Raffle ticket price - 0.029 ETH

8:55pm PST - This is gaining traction 👀

Raffle ticket price - 0.039 ETH

9:06pm PST - Is this raffle really going to happen? It just might…

Raffle ticket price - 0.055 ETH

10:43pm PST - I got preoccupied with some other things and took a shower. Oh no! What happened to this grand experiment?

Raffle ticket price - 0.03 ETH and dropping

I checked the developer’s Twitter and they had an update.

Ah bummer…glad that these devs are honest and didn’t run off with the money!

PS: If this raffle actually happened, the last ticket would’ve cost

It literally pays to be early in this case lol.

But wait…what’s this?!

A SEQUEL? My popcorn is ready.

A couple more things about Sudoswap:

There’s a great Dune dashboard that shows some Sudoswap stats:

It’s clear that Sudoswap is gaining traction as a marketplace. Will it take over Opensea? Quite unlikely IMO, but who knows.

Also, bHeau’s explainer on Sudoswap makes a great point about creator royalties.

This is true — Creators could create their own pools and charge a swap fee, which would effectively function similarly as a collection on a marketplace like Opensea. Less convenient, but it is a solution, albeit an imperfect one.

If creators did this, they’d also get paid immediately instead of waiting several weeks for Opensea to pay out the royalties.

So, students! What have we learned from yesterday and today?

That’s more like it Bart!

As creator-unfriendly Sudoswap is, there are many interesting applications on Sudoswap.

See you tomorrow folks!