I’m going through a breakup — Not with a person, but with Dapper Labs. I hope it will be more of a break, but I believe my experience will help inform Web3 about the challenges and opportunities of building companies and brands in the space as well as the psychographics of NFT consumers.

I have much to be grateful for regarding NBA Top Shot. They were the first NFT I purchased and brought me and countless others into NFTs and Web3. Dapper as a company has revolutionized the NFTs for the masses and created a juggernaut portfolio of products.

However, the growing pains are real for Web3 and Dapper alike. The frenzy of new money and hype pumped up valuations of many NFTs including Top Shot moments.

Let’s start at the top though. For the uninitiated, what is NBA Top Shot? They’re essentially digital NBA cards. From this…

…to this. Similar concepts apply: scarcity, varying degrees of rarity, a niche community of collector.

However, the digital collectible concept comes with some advantages:

Liquidity: If you wanted to buy or sell moments, you don’t need to worry about packaging, shipping, or grading. You can just list and Dapper takes a 5% marketplace fee. Way better than eBay’s 12.35%.

Verifiability: Is the card a fake? No need to worry about that, Top Shot moments are verified on Dapper’s FLOW blockchain.

Integration with the physical world: Digital collectibles grounded in physical brands have a lot of ‘phygital’ potential to exhibit utility for holders. Top Shot has done a decent job on this front.

And the volume is not to be reckoned with.

$1B in secondary sales, wow. And don’t forget about all the pack sales that Dapper has…Let’s look at the “WNBA Run It Back - 2008” packs that will be sold this Friday.

3,500 packs sold at $79 a pop = $276,500 in revenue. Not bad right?

There’s a Magic Johnson pack that will be on sale in a couple of weeks.

1,600 packs sold at $399 a pop = $638,400. Now we’re talking.

Alright, so I think we all have a foundational understanding of what Top Shot is. So what about me?

TPan’s Top Shot Stats

Moments bought/owned/sold (lifetime): 1,013

Moments owned currently: 114

Moments currently listed for sale: 38

Lifetime purchase value: $█████ (enough for a nice car, sigh)

Why am I sharing these stats? To show you I really believe (and still do!) in the prospects of what Dapper is trying to do. That said…it’s been pretty painful…

Did I allocate my capital optimally? Nope, fortunately learned a lot from it and am applying these principles to my other decisions in the NFT space.

Who’s to blame for it? Myself, duh.

Above is my portfolio valuation over the past 12 months. It went from up ~3x to….down bad.

That said, I think there’s a lot of lessons on the personal front and Dapper front.

Personal

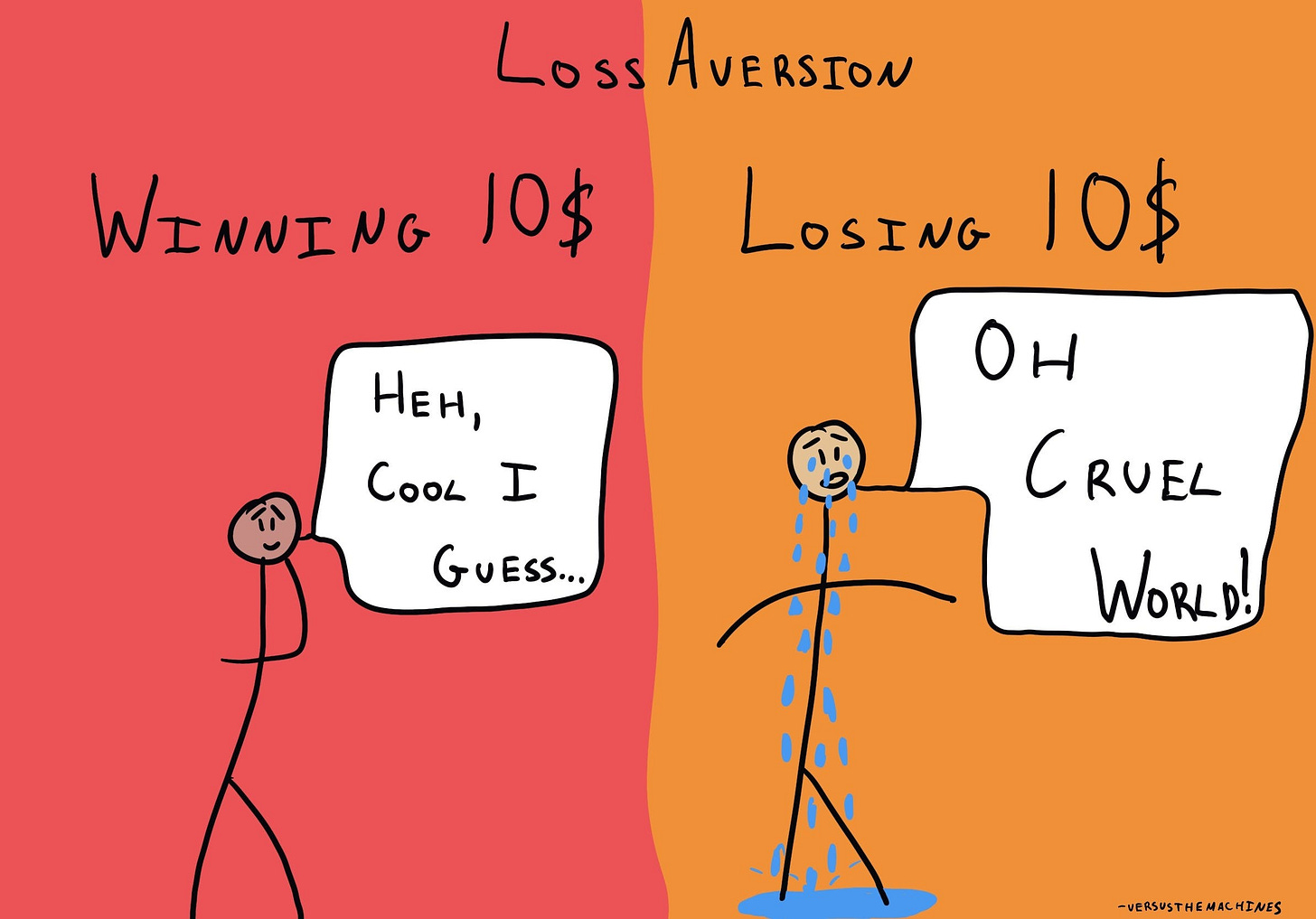

Take the L: One beautiful things about humans is our emotions, and they sure are complex. Those that are inexperienced (like myself) fall victim to loss aversion. Instead of cutting our losses, we hold onto what we have, thinking that there is that 1% chance an investment may recover, or that if we sell that we’re a quitter. Taking emotions out of a decision, especially when it comes to investing, is critical. This is especially true with assets that are considered more speculative, like NFTs.

Evaluate on a relative basis: Why am I selling these moments now? Well, I’ve been meaning to decrease my exposure to Top Shot for some time and I have to a degree. But I also believe that in this market, there are better opportunities in other areas. Sure, Top Shot moment values can easily 2x from here, but I believe there are other opportunities that can 10x in the same period of time and I’d rather have a small war-chest for those opportunities.

A brand name isn’t everything: The NBA is a brand that anyone can get behind. However, that will not singlehandedly guarantee success. More on that in the below section.

Dapper

I don’t work at Dapper, but I’m believe they’ve thought through a lot of these topics and are actively working to improve the product and users experience.

IP Partnerships are a double-edged sword in Web3: Getting the rights to use the NBA trademark and its respective players is HUGE. However, that leads to a lot more red tape in virtually every aspect of the product. Whether it’s product, marketing, or operations, there are limitations to what can be said and done.

Think Top Shot’s $1 billion in secondary volume is impressive? Bored Ape Yacht Club has had more than $2.8 billion in secondary transactions on Opensea alone (not even including other marketplaces, trades, etc.) and they’ve haven’t been around as long.

How can companies with globally recognized brands like the NBA grant their partners more flexibility? If they don’t, native Web3 brands are going to start taking a larger share of the pie with their strategy of letting the community create and market alongside them.

You don’t get to choose when hypergrowth happens: Every company wishes they could have a ‘Top Shot moment’, where literally hundreds of thousands of users organically signed up and purchased moments and got introduced to the NFTs. If Top Shot was a physical product their items would have just gone out of stock. If Top Shot was a physical marketplace, they would’ve have just adjusted pricing like Uber and Lyft do with surge pricing.

However, Top Shot was a digital marketplace and what they did to satiate demand was to increase the supply drastically. Great in boom times, but when the market calms down the hangover begins. This isn’t limited to Top Shot. This happened with the COVID pandemic and blockchain games like Axie Infinity. Companies like Netflix grew at an impressive clip during the pandemic, only to experience the beginnings of a nasty hangover starting earlier this year.

I’m not sure what the right answer to this would have been because it seems the demand ‘hangover’ would have happened regardless. That said, would gating consumer demand by bringing in new users more thoughtfully vs. opening the floodgates been a better strategy, resulting in a healthier economy?

$1 moments on a bench player who’s on a terrible team? There’s 60,000 of these…yikes.

Lean in on phygital or digital/digital experiences: As mentioned earlier, this is already happening, but IMO there is still a ways to go for Dapper to manifest its vision of digital > physical in the collectibles space. Harder to do vs. a Web3 native brand because of the legal/licensing implications with a brand like the NBA, but it will come.

Buying vs. selling experience: Buying a moment? Great! Search for the player/moment you’re interested in and purchase it. Easy peasy.

Want to sell a moment? Great! Choose the moment you want to sell and price it accordingly. It’s a little trickier if you have a “rarer” moment like serial number #99 out of 10,000. It might be worth more. But only as much as a buyer would be willing to pay.

Want to sell 500 moments? Great! Go through the selling process but 500 times.

Want to open 150+ packs (there are 3-9 moments per pack depending on the pack you purchase) and sell them all like TPan did? Great! Go through the selling process but add the step of opening up all those packs…one…at…a…time…

Want to reprice your moment? Great! Remove the moment and relist the item. Keep in mind that this all happens on the blockchain, so all of these steps take several minutes longer due to the blockchain confirming your actions.

Purchasing moments is low friction. Selling moments (especially in bulk) is high friction.

I haven’t timed it, but I have spent dozens of hours over the past few weeks selling my moments, and I’m still not done. I know for a fact there are many others like me in a similar situation, but they aren’t taking the time or effort to liquidate. If all the people in the TPan situation sold despite this selling friction, the Top Shot market would crater much further than where it is now.

One could argue this is a dark pattern to prop up the Top Shot market. However, I believe that building features like bulk selling and suggested pricing is really hard to do, and not the most important thing on Dapper’s roadmap at the moment. If there was a bulk buy feature and not a bulk sell feature, that’d be a different story though.

After selling ~90% of my moments, I’m still a top holder in terms of $ value. W😮w.

Dapper arguably has the most coveted brand partnerships in the space and has a great first+second+third party strategy that puts it in a great position. I believe they have and will continue to make the adjustments needed to keep the community happy while building a viable business.

So back to the breakup — When will I be back? TBH, I don’t know. I’m still holding onto my rarer moments as a continued bet on Top Shot and what they will do.

However, we all need to take the L sometimes. It hurts, but I’m glad I ripped the off the band-aid. I know this lesson will apply to future investment decisions I come across.

See you tomorrow folks :)