Writing meme of the week, courtesy of Allen.

Anyway.

Today’s topic was indirectly inspired by Rug Radio, and you can listen to the recording here!

Time flies when you’re having fun…and when you’re in pain I guess. It’s been approximately 3 months since the crypto bear market began, so I figured it’s a good time to take a step back to share my thoughts and observations around the NFT market.

Let’s take a look at the price of ETH (the general bellweather for the NFT market, though plenty of action in Solana and Tezos too). Here’s the price chart over the past year:

Here’s the price chart over the past 3 months:

Honestly, I would want a donut regardless of how crypto markets are doing.

So what’s going on thematically? (also note that some of these themes are applicable to equity markets and other asset classes in general, not just crypto or NFTs)

Mental and emotional fortitude are critical

The memes layered on top of the charts were what most people in crypto and other markets were feeling. However, there were people (professional traders, those that have been through these cycles multiple times, people without a personality, jk heh) that were prepared for this downturn and made disciplined moves.

I unfortunately was not one of those people, but am grateful to have the awareness to understand what was going on in my head.

During these times, it’s important to:

Maintain a long-term thesis, conviction, and POV

Keep your emotions in check. If you are focused on making a profit, don’t get attached to your jpegs

Be self-aware. Take a step back if you’re getting too emotional about what’s going on (you’ll know when you get to this stage)

Find a support network: Friends, family, others who are in the same community

These traits and tactics apply to startups, anyone that is affected by the job market, or going through a hard time in general.

Flight to Quality

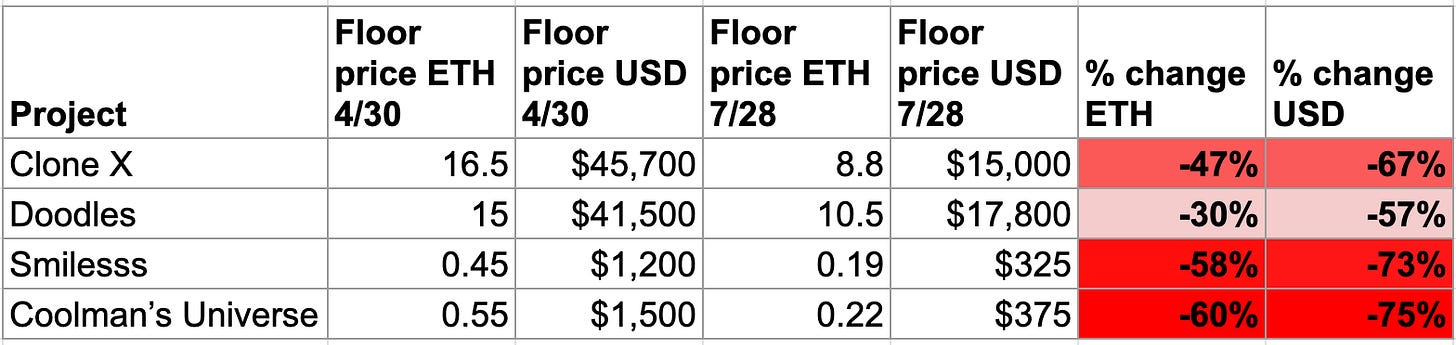

This will be a long-term theme regardless of market conditions. Let’s compare a few projects and see how they've fared from an ETH and USD standpoint. I am a holder of all these projects and genuinely like them, but we see the performance faring differently in accordance with current market conditions.

This is not a thorough analysis, but I think you get the general point. Many of the smaller projects have basically gone to 0, so I think Smilesss and Coolman’s still has a good shot long-term.

It’s sorta like stocks right now as well: Would you rather put $1,000 in Apple stock or Peloton stock today? Probably Apple, it’s a safer bet in uncertain times. Peloton might actually perform better in the short/medium-term, but stability and growth from Apple is more guaranteed.

Another form of quality in the NFT space is digital art. A couple examples:

Chromie Squiggles

Yup, these things are worth ~$15k each. If you’re wondering what you’re doing with your life right now, you’re not alone because I’m wondering the same thing. As you can see with the chart below, there’s probably been some capital rotation from avatar NFTs into art NFTs.

Also, this 1/1 by XCOPY (one of the biggest digital artists in the NFT space) sold for ~$436,000 yesterday. Now we’re ALL wondering what we’re doing with our lives, right?

There’s still a market, it’s just picky.

Speaking of Picky…VC’s

Are they still out there slangin’ their warchests at companies? Ok, maybe not throwing money around at companies like they were a few months ago, but they’re still out in force.

Starting with VC fund announcements:

1Confirmation: $100 million NFT fund announced in June 😳

Multicoin: $430 million fund, announced a couple weeks ago 😳 😳

Variant: $450 million fund, announced yesterday 😳 😳 😳

a16z: $4.5 billion crypto fund announced late May 😳 😳 😳 😳

Note that these funds announced the fundraises during the bear market. It’s not like they started to pitch to their LPs (limited partners, the rich people/institutions that fund the funds) a few weeks ago. However, there is still strong interest.

And on the note of 1Confirmation…the founder of that VC fund bought this JPEG a couple weeks ago.

Dumb? Maybe, but…Here is a small sample of his fund’s investments.

So back to these funds who just raised a bunch of money. Where are they looking, where are they deploying their capital?

There has been a lot of froth, but with the slower market, it’s easier to sift through the good and bad opportunities.

Here’s a sample of companies that have announced new rounds of funding in the past couple of weeks:

Veefriends: $50 million Seed round (LOL), announced yesterday.

Lol’ing because seed rounds are not normally that large. But crypto is an anomaly.

And yes the ‘Vee’ is for Gary Vee. You might think he’s annoying, but I wouldn’t recommend betting against him. He outworks everyone.

Unstoppable Domains: $65 million Series A at a $1 billion valuation

Hang: $16 million Series A building the future of brand loyalty

Stadium Live: $10 million Series A building a fantasy sports metaverse, announced yesterday

The opportunities are there, VC’s just need to wade through the sea of vanity metrics, dodge DM’s of people throwing their pitch deck at them, and sift through buzzwords uttered by entrepreneurs who have never purchased a NFT before. 😂

Regulation pushes forward

Woohoo!

Bull market, bear market, governments are going to govern. That also includes (controversial) enforcement.

Lol at the Fortune headline, it actually made me chuckle inside. Bravo.

Local governments don’t want to miss out on the fun either.

These are all headlines from this week. It really isn’t boring around these parts. Great for people with ADHD.

What NFT projects have done well?

Do you really want to know? There’s only 1. Well, probably more than one. But the one that sticks out to me is the one I’ve already written about multiple times.

Even though Goblintown has fallen from its highs like everything else, it’s important to note that this was a free mint. Yep, it started from 0 in a bear market. No other 10k PFP project (at least to my knowledge) has achieved this in the past 3 months.

Don’t know what I’m talking about? Enjoy scarring your eyes:

But seriously…if you’re working on your own NFT project, at a company considering getting into Web3/NFTs, or a marketing/growth professional, read those dives.

The other reason why I brought them up again is because several members of the Goblintown team hopped onto the Rug Radio spaces this morning. And it gave a great insight to how they were able to make things work despite market odds. Much of this applies to companies in general, but Web3 has its twists.

Team: This was emphasized multiple times — Team matters and getting the best people to work on the project was key. Everyone knew their role and excelled at it.

The team also incorporated a ‘Yes, and…’ culture. This is not quite the same as ‘no idea is a bad idea’, but rather how do you take an idea and build upon it?

Have fun: The team worked hard, but genuinely had fun doing it. If you work on a project with the sole expectation of getting rich, it probably wouldn’t be too fun. If you realize that there is a chance of failure and focus on having fun, things change.

Being in tune with the community: The team adjusted plans based on feedback and ideas from the community. They listened and moved in real-time. Web3 communities are powerful and if you combine them with your product/brand you get a 1+1= 3 type of impact.

There you have it folks. More themes will come about as everyone continues adjusting to this new normal. But we adapt, we thrive, and we have a little fun during this bear market. 🤪

See you next week!