As the space continues to adjust to the realities of a slower market, those that are in it for the long haul see things differently. Everything in crypto from a $ standpoint may be down, but that doesn’t tell the whole story (it does make great headlines though!).

Below are 3 examples from different corners of Web3 that confirm that the space is still thriving despite the exclamations pronouncing Crypto is dead.

Opensea volumes

A relatively unnoticed tweet considering all the big headlines the past couple of days. As a growth guy, I love me some numbers! What is Mando saying in this tweet? Let’s unpack that suitcase.

BTW, the Dune dashboards are from Richard Chen of 1Confirmation, a Crypto VC fund. Awesome to see VC’s building to benefit the public 😌

PS: Ignore the tiny bars at the very right. Those are August numbers and we’re only 2 days into the month, so of course those bars would be 🤏

Opensea volume in USD

This chart and its corresponding numbers would be what most skeptics are using for headlines. In $ terms, the environment is down. BAD. 12-month lows bad.

January 2022 $ volume: $4.857 billion

July 2022 $ volume: $528 million

That’s a -89% change in NFT $ volume. Holy guacamole. It’s more understandable why some folks in the space are in despair if they held over the past 6 months.

Great headline…but why?

Opensea # of monthly NFTs sold

January 2022 # of NFTs sold: 2.285 million

July 2022 # of NFTs sold: 1.702 million

That’s -26% from January highs. Down, but not bad.

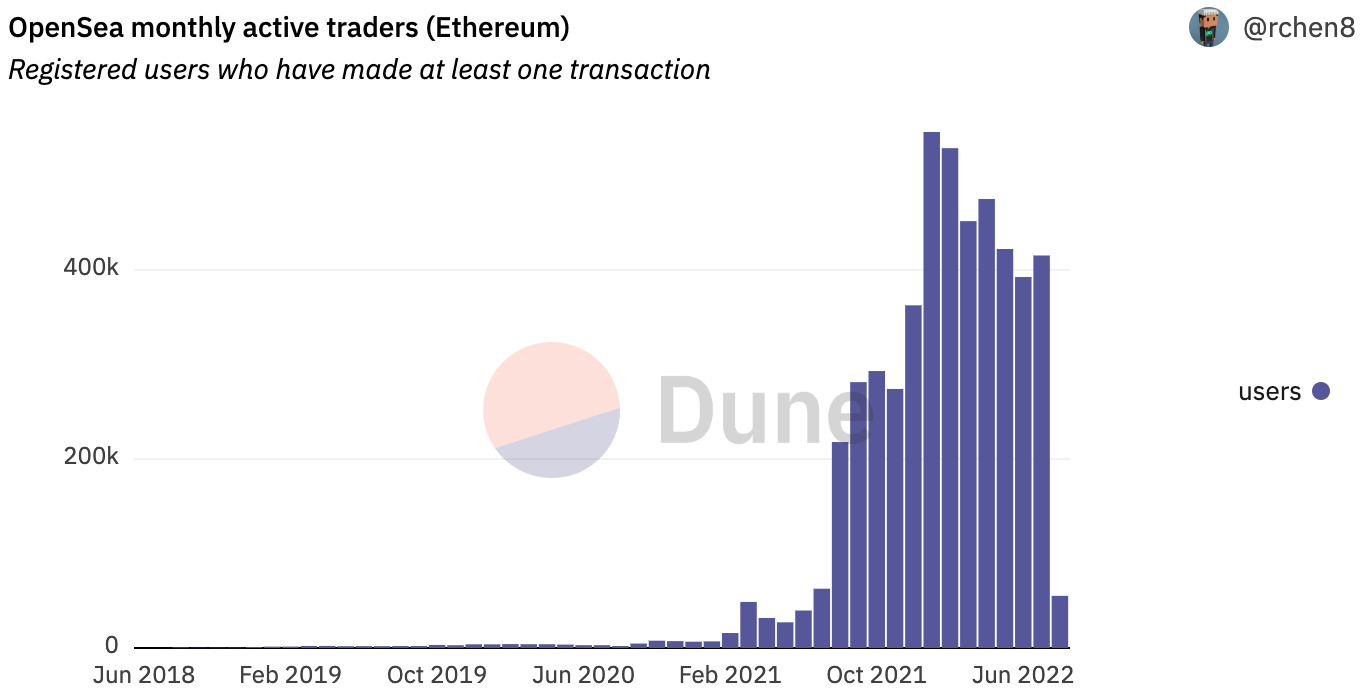

Opensea # of monthly users making a transaction

January 2022 # of monthly users making a transaction: 546,127

July 2022 # of monthly users making a transaction: 415,435

That’s -24% from January highs. Also down, but not bad.

So what’s going on here? Like @greatmando_nft said:

ETH is down from $ terms. To add some more detail to this, NFT valuations from a ETH price standpoint is also down. So this is a double-whammy of sorts. Taking the example from last week’s post about the bear market with a sample of NFTs that I hold:

The first whammy is that ETH relative to USD is down.

The second whammy is that NFT valuations are down, regardless of whether it’s a top tier project or not. This is due to a lot of external/internal factors — overall market, valuations in general were too high, profit-taking, etc.

When you combine the two, the down bad scenario compounds.

This is not the ‘teamwork’ I would like to see, but it’s teamwork nonetheless 😂

Free mint meta. The space has gotten stingier, so one of the ways for projects to have a chance at success is via launching the project through a free mint and gain revenues through secondary sales. This is less desirable vs. paid mints (revenue upfront), but it a result of teams adapting to current market conditions. Another strategy is reducing project mint size, which also results in reduced capital inflow for the team.

Because many recent projects are a free mint, there is still a large number of transactions and users participating in the NFT space.

That leads to some interesting questions:

Quality vs. Quantity: We still are at high levels of engagement, but what is the quality of it? Clearly much lower if we define quality by $ value.

If we define quality by second, third, nth transaction, that might be another proxy.

If we define quality by monthly retention - User transactions in month 0, then month 1, month 2, month n, that could be another measure

Break out users transactions with the value greater than a specific $ amount? Would that help us better understand users that are actually buying/selling vs. free minters?

Who has left? Who is staying? Who are the newcomers to Web3 and NFTs during these rough times? Who are the ‘tourists’ that have left?

For the people who have left NFTs, have they left completely? Or are they spending their time in Web3 but in other ways, like joining DAOs, working full-time at a Web3 company, etc?

Because of the point around free mint meta above, is there a more diverse international audience? Or is there geographical consolidation?

What would it take for people to come back? Everyone’s motivations for joining and staying vary. What about motivations to come back? It’d be cool to see an industry-wide user research initiative around this. Is there a user research DAO out there? Lol

If some came for the money, would they only come back for financial purposes? Would they come back for non-financial reasons…ever? If so, what would encourage that?

How important is the social and/or utility component for this? For example:

Who will be the first celebrity to onboard 100,000 fans into Web3/NFTs in a thoughtful way? How will they do that? Would people who left be convinced to come back because of that celebrity?

Which brand will be the first to onboard 1 million consumers into Web3/NFTs in a thoughtful way? How will they do that? Would people who left be convinced to come back because of that brand?

Lastly, note that those Dune charts are for ETH NFTs and Opensea stats only. That said the overall NFT ecosystem follows the trends that Mando and I have pointed out.

So things look pretty slow 🐢, where’s the ‘all at once’?

Gucci x Apecoin

Not to be outdone by Tiffany & Co, Gucci had a big announcement earlier this morning.

My reaction in a meme:

The other luxury fashion juggernaut that is not LVMH is Gucci’s parent company, Kering. I don’t know if there’s a luxury fashion Illuminati that has decided Crypto and Web3 are the next big thing…but something is happening.

Similar to LVMH, this isn’t Kering’s first announcement related to the space. Recently Gucci and Balenciaga have announced that they will accept crypto as a form of payment.

On top of that, this announcement is specifically related Apecoin, the currency of Yuga’s ecosystem. This is a cryptocurrency that just launched a few months ago and is associated with a NFT collection of Ape jpegs. Impressive if you ask me.

The VMA’s

MTV’s annual VMAs (Video Music Awards) added a new category for this year’s show: Best Metaverse Performance.

Who’s being nominated and on what platforms?

Holy guacamole x2, these are some big names! Although I haven’t watched any of these performances, it seems that mainstream metaverse and interactive entertainment experiences are going to be a thing. Note the platforms these artists performed on: Roblox, PUBG, Minecraft, Youtube, Wave (haven’t heard of this one).

I’m curious to see when the first blockchain/Web3 associated metaverse (Sandbox, Decentraland, Otherside, etc.) performance will be nominated for this type of award.

Wait a second, I may have spoken written too soon…Buried in Wave’s FAQs

Let’s do some more digging. From an article in May related to a XR event in partnership with Teflon Sega, a virtual influencer.

So the Justin Bieber concert on Wave is not specifically related to Web3/NFTs. But Wave as a platform is getting into the space in general. 🤔

🐢 Slowly, then all at once 💥

See you tomorrow folks!

Thanks for laying out the insights on NFT market Tpan