#278: The 10 incentive layers of the Blast Airdrop

🎁 How many layers of incentives are too many?

Last week I held a poll on what I should write about and WIF won by a narrow margin. Today’s piece will cover the Blast’s 10-layer incentive structure. And no, this is not a recipe for a dip.

For anyone unfamiliar with Blast, I recommend you read my piece about the Layer 2 network from a few weeks ago. The network went live on Mainnet on February 29th.

Users who bridged over assets eagerly awaited this moment, finally able to interact with different dapps (decentralized apps) that went live, withdraw their assets to somewhere else, and learn about the next phase of incentives to retain and engage users. Pacman (founder) and his team did not disappoint, and maintaining their reputation for creating novel incentive loops. In fact, they probably took it to a whole different level.

When the Mainnet went live, users went through a series of screens explaining what the next stage of incentive mechanics looked like on Blast Mainnet. Unfortunately, I didn’t get the chance to capture them, but Zeneca provided an idea of what it looked like. After the onboarding sequence, users are taken to the airdrop dashboard, where the real action is, and oh boy it’s 😵💫

My first reaction to this was holy crap. Compared to many other dashboards in both web2 and web3, this is overwhelming. After digesting the different components of Blast’s airdrop dashboard and incentive mechanics, I found this to be impressive. Kudos to whoever was in charge of designing this.

Peeling the layers of Blast’s airdrop dashboard

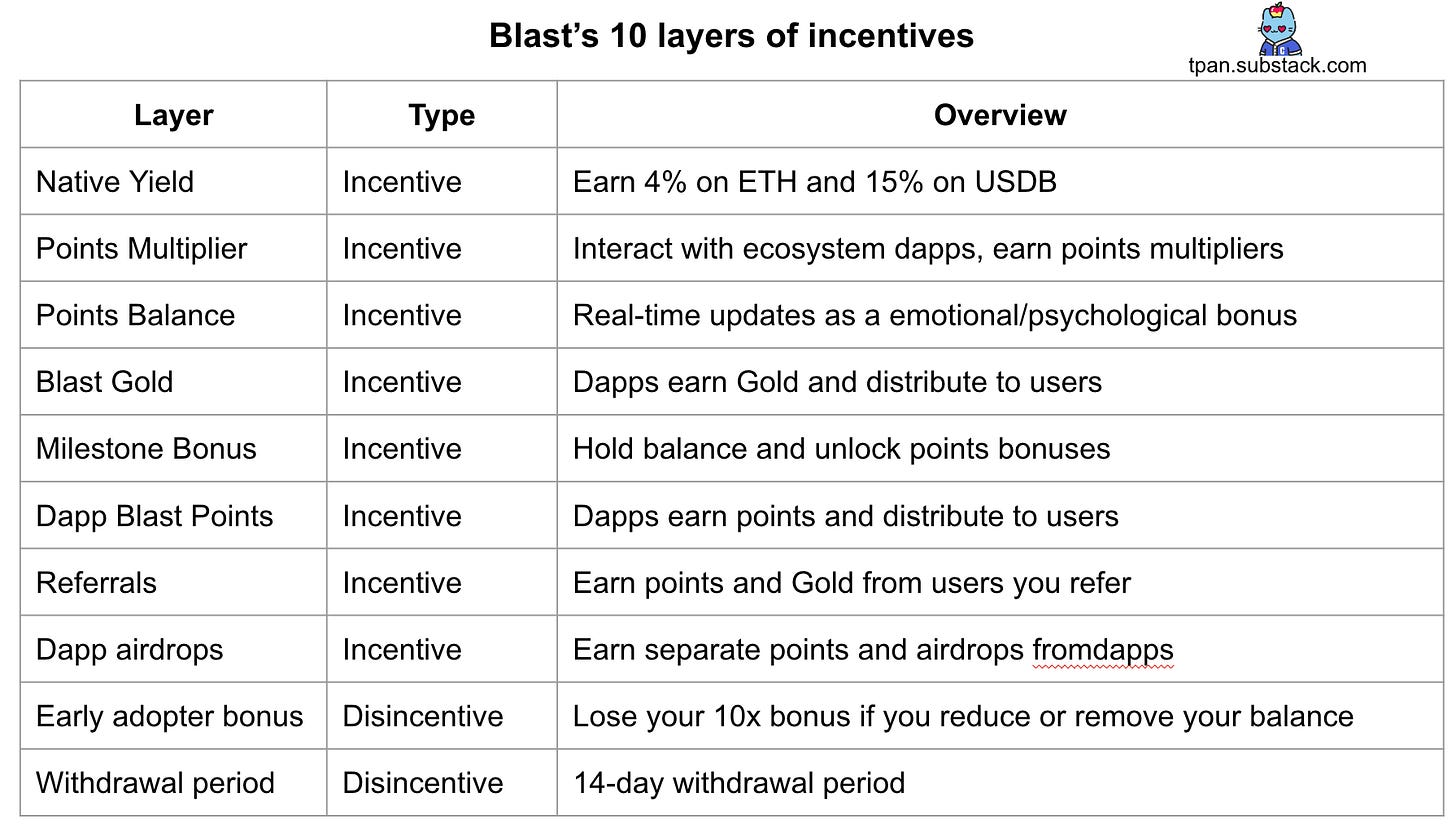

The best way to understand what’s going on is by breaking the program into its separate components. We can identify 8 from the above screenshot.

Let’s go through each of them:

1. Native yield

This is one of the key differentiators of Blast (although IMO you’ll start hearing the term ‘native yield’ more in the coming months from other platforms and networks). Any ETH or USDB on Blast earns 4% and 15% respectively, just like how your bank checking account ‘natively’ earns interest…at a much much much lower rate.

USDB used to earn 5% yield, and as of yesterday it increased to 15% due to some DeFi craziness happening in the space. If you’re curious about how this is possible, here’s a good overview.

So if you bridged assets over to Blast and don’t do anything on the network, you can still earn yield at high rates leaving it there.

2. Points Multiplier

No good crypto incentive program is worth its salt without a classic points multiplier. By using promoted Blast Dapps, users can earn points multipliers. The more qualifying dapps you use, the higher your multiplier and the more points you earn.

There are currently 12 featured dapps that will qualify for multipliers across three waves: March 12 (today, still not released as of this writing), March 31, and April 30.

Naturally, these waves are spread out to encourage engagement and retention over a longer period of time.

3. Points balance

The points balance is a pretty vanilla element when shown in a screenshot, but if you look at it live it updates in real-time. Where else does this happen?

I’m not saying Blast is the same as slot machines, but the psychology of numbers going up in real-time hits the dopamine receptors in a way that static balances don’t. If you hold more assets on Blast and have a higher multiplier, that real-time number goes up even faster.

A few additional notes on the real-time points balance:

If you leave the airdrop tab open, do something else on another tab, and then come back, the points balance rapidly speeds up to the accurate real-time balance (like if you fast-forwarded a video). It doesn’t automatically jump to the updated balance. It’s almost like a hack to get the number go up faster and it’s psychologically pleasing to watch.

The points balance section also shows the per hour rate of points earned. This is another angle to encourage users to increase their points balance by increasing the rate at which the points are earned.

Points are updated to the hundredth, which allows users with small balances to feel the same effects as someone with a much larger balance. Number go up feels good, whether it’s by .01 or by 100.

4. Blast Gold

Blast gold is the dapp equivalent of points. It’s distributed manually at a 2-3 week cadence, and distributions are publicly announced. Gold is distributed directly to the dapps as an additional tool to reward their users for engagement.

The first round of Blast Gold distribution should be happening soon, so we’ll see how it works.

5. Milestone bonuses

The series of treasure chest symbols below the numbers aren’t just for show. They’re point bonus milestones.

By hovering over each chest we can see how they get unlocked.

Notes on this incentive feature:

The points bonuses are personalized based on the user’s balance, and I was able to confirm this by checking with someone else. As you can see in the screenshot below, this user has a lot more assets on Blast than I do, earning 53.9k points by hitting the first milestone compared to my paltry 9.7k points.

The time to unlock each bonus is dynamic as well. The more assets you have on Blast (or the larger your multiplier is), the quicker each bonus is unlocked. We can see this by my 9 days vs. this person’s 5 days.

The time is a live countdown timer. Hold more assets or earn multipliers ➡️ more points earned ➡️ less time it takes to unlock each point bonus

Each successive point bonus is larger. For example, my first bonus is 9.7k points, while the last bonus is 52.6k points.

If your point-earning rate isn’t high enough, you won’t be able to unlock all the bonuses by the points redemption deadline in May, presenting another opportunity to encourage users to bridge over more assets onto Blast

6. Dapp Blast points

Just like individual users, Dapps earn points on Blast too based on their asset balances. Dapps are strongly encouraged to redistribute these earned points back to users. This ideally addresses the concerns of users who are hesitant to use their ETH or USDB on dapps, reducing their point accumulation rates.

7. Referrals

A tried and true mechanic with a couple twists. Referrers earn 16% of the points earned by their invitees and an additional 8% of points from their invitees. On top of that, you earn a % bonus on the Blast Gold they earn too, making this a multi-level referral program.

8. Dapp airdrops of their own token

Blast isn’t the only one with a points program that will turn into an airdrop. Some Blast ecosystem dapps have their own points programs that will lead an airdrop as well.

Putting the first 8 layers together

If you want to learn more about each of these components, you can refer to the Blast documentation here.

Below the airdrop dashboard fold, you can see how the airdrop incentives are put together, specifically layers 4, 6, and 8. The total points column shows how many points have been earned by the dapp and the bar indicates what % of those points have been distributed to users. This serves as a reinforcing mechanism to encourage dapps to redistribute their earned points to users vs. holding it for themselves.

How was this list of apps chosen? They were the winners of the Big Bang competition, and one of the perks for winners was that they would be promoted to the Blast community.

What about the 9th and 10th layers?

As if 8 layers weren’t enough, there are 2 additional layers to Blast’s incentive program. Specifically, these act as disincentives or deterrents for users who are considering bridging their assets out to somewhere else.

9. 10x early adopter bonus

Users who bridged assets to Blast prior to Mainnet launch have the opportunity to earn a 10x bonus on points earned during the early access phase.

How is the 10x bonus earned? The points are split into #5, the chests that are unlocked over time.

If you use your balance on ecosystem dapps, or a portion (or all) of your balance on Blast, you will won’t be able to unlock all of your 10x bonus. This also explains why I won’t be able to unlock my last chest if I don’t increase my current balance which was reduced because I minted some Blast NFTs.

The withdrawal UI also has some clear negative reinforcement.

10. 14-day withdrawal period

Are the dapps lame? Are the airdrop incentives too confusing? You can always bridge out. Wait a second…

That’s certainly a deterrent. There are technical reasons why withdrawal periods on Layer 2’s take a while and there are alternative ways to bridge out, so it’s not completely Blast’s fault.

But we don’t want to bridge our assets out because there are so many incentives. Right? RIGHT?

Putting it all together

That is some serious engagement and retention loop wizardry going on here, and I’m only focusing on the user perspective. It’s obvious this isn’t for most users and it isn’t made to be, just like how Blur (Pacman’s NFT marketplace product) isn’t for everyone.

Themes

Similar to lotto scratchers…

…there are many ways to ‘win’:

Earn points by taking the passive approach, leaving your balance untouched

Interact with the various multiplier and dapp incentives

Withdraw from your Blast ecosystem while retaining your early access points

A combination of the above

The game theory and optionality remind me of credit card rewards programs. You can ‘earn back’ your annual fee in a variety of ways:

Take advantage of all the perks the card has to offer (3x points back on

Redeem points for specific limited-time offers (eg: 1 point = 1.5 cents on Apple purchases)

Use the rewards platform (earn 10x bonus points if you book with the travel concierge)

Want to cancel your credit card? You might get dinged on your credit score…

If you take a step back, there are more parallels than you think. We’re just used to credit cards and rewards programs because they’ve been around for a lot longer. Also, their brand colors aren’t highlighter yellow.

Is Blast going to last?

So far it seems like it. There is almost $3 billion and 450,000+ wallets on the network with more dapps launching every day. As users get more familiar with the Blast ecosystem and its incentives, find a dapp they are interested in using, or find a NFT project they like, the odds of staying outweigh the odds of leaving.

The other way to answer this question is regarding the incentive framework the team has come up with, and I think the answer to that is a resounding yes as a playbook. Just as Blur’s incentive mechanics spurred influenced the design thinking of other points programs, I believe Blast’s incentive structure will be a large influence on other projects and ecosystems.

Incentives as a bootstrapping mechanism

Yes the number of wallets and the $3 billion TVL are eye-popping, but what’s most impressive to me is that Blast is using the airdrop and incentive program to bootstrap an ecosystem with a diverse group of dapps and users. The fact that Blast did this in 3 months makes this achievement even more notable.

Instead of bootstrapping, we should call it blast-strapping. And that’s my cue to wrap this up lol.

See you Thursday!

I've been putting 50 dollars left and right in a multitude of LP's for liquidity, staking or other. And trading small amounts on different dexes. Bit overwhelming but hopefully it'll be time well spent. When I see my points in comparison with the millions and millions of points distributed elsewhere, I doubt it tho xD