#309: Holdium - The Memecoin Marshmallow Experiment

💎 How can the concept of holding and rewarding holders be expanded?

Over the past couple weeks, I caught wind of a new memecoin, Holdium. Yes,

Thank you DJ Khaled for lending me your catchphrase. Despite how tiresome memecoins as a whole are, a select number of them are incorporating new distribution, incentivization, and retention mechanics that will gradually spread to other areas of the crypto ecosystem. I believe Holdium is one of them.

How does Holdium work?

Created by Nigel Eccles, co-founder of FanDuel, one of the largest sports betting platforms in the US

Holdium is a memecoin designed to reward holders, specifically those who don’t sell their airdrop allocation

The team pre-selected 30 different memecoins from the Solana ecosystem to determine which wallets qualified for the airdrop

Holdium’s airdrop allocation will be vested over 18 months, with airdrops occurring monthly

The first airdrop will be on July 15th

In order to remain eligible for the monthly airdrop, holders must not sell or move their $HM

If you sell your tokens, the rest of your airdrop allocation will be burned, and “we will also have to make sure your wallet remembers how much of a paperhand you are...”

If you want to register your wallet for Holdium, you can sign up here (ref link).

What makes Holdium interesting

Holdium is attempting to tackle one of the thorniest problems in the space: creating a high-quality community at scale, aka going for quantity and quality, aka having your cake and eating it too 🍰

Want to get a ton of users or holders? No problem. Start a points program, incorporate quests, and tease an eventual airdrop for your product.

Want to build a high-quality community? No problem. Build a community through non-scalable efforts, high curation, and time. Near impossible to do in the memecoin space.

I’m oversimplifying these complexities, but Holdium has factors that at least partially address them.

Quantity: Free airdrop

Who doesn’t love a free airdrop? Over 120k wallets have registered onto Holdium, and the team will also airdrop 5% of the token supply to ~140k Solana Mobile Chapter 2 holders, which could bring the total wallets to 200k+ by the time the airdrop happens.

Quality: Allocation based on holdings

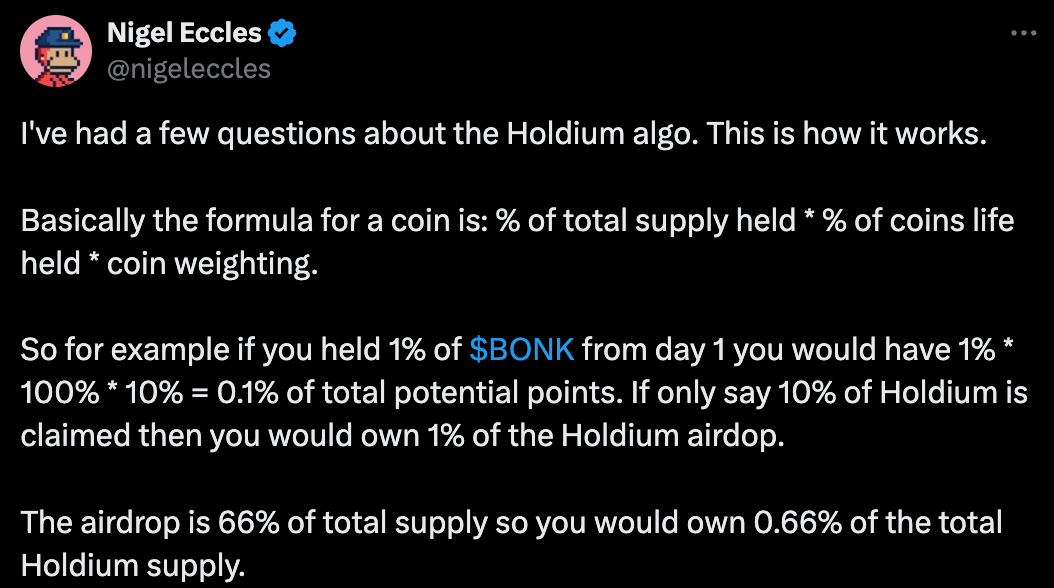

Airdrop allocation is proportional to the amount of memecoins held and the duration they’ve been held for. Nigel provides an example of how this works:

The definition of holding also expands to all qualifying assets ever held, meaning you can also earn Holdium points if you used to hold a qualifying token at some point in the past.

The longer you hold, the larger your Holdium airdrop is, and this serves as a proxy for quality.

Game theory

Holdium is structured in a way that promotes incentives that haven’t been done at scale in the realm of memecoins:

If I wanted to focus on maximizing my profit from the airdrop, should I sell immediately? Should I wait a couple of months then sell?

If I have multiple qualifying wallets, should I register each separately so I can sell my airdrop from some of the wallets while other wallets can hold and continue to receive the monthly airdrops?

“If you sell your allocation early, not only will the rest of your airdrops be burned, but we will also have to make sure your wallet remembers how much of a paperhand you are...” What does this mean and what are the criteria for being a paperhand? 🤔

“Stay on the good list and hold strong! Who knows, we might have some surprises for the real diamond hands, too!” What does this mean and what are the criteria for being a diamond hand? 🤔

I imagine many will ignore the last two points, but it will be worth noting what these carrots and sticks are and how they may influence behavior. This will become especially interesting if Holdium has a market cap that catches the attention of the broader space.

The memecoin marshmallow experiment

Holdium reminds me of the Stanford marshmallow experiment from the 70s that I fondly remember from my Psych 101 course in college.

TLDR: Psychologists took children into a room and put a treat in front of them. If they waited 15 minutes they would receive a second treat. Children who were able to delay gratification tended to have better life outcomes.

I remember this experiment well because of the memorable videos of cute kids resisting temptation and also because I knew that I would crush it if I were a part of the study. I’m the type of person who is fine with delayed gratification, sometimes to a fault.

Although future tests showed that the results and conclusions were much more nuanced than delayed gratification = success, the concept does create a new area of exploration around incentivization.

Extending the duration of the marshmallow experiment

Holdium is creating its own study of sorts, and turning the 15 minutes into 18 months. The real world is much more complex than a closed environment and the blockchain enables unique ways for more of these treats to come to those who wait, or more specifically, hold.

What are some examples of this that could happen with Holdium and beyond?

Within Holdium

Although getting airdropped Holdium will be another exciting opportunity for free money, I do believe there could be a cost associated with it depending on the action(s) taken and when they’re taken.

Going back to the point “If you sell your allocation early, not only will the rest of your airdrops be burned, but we will also have to make sure your wallet remembers how much of a paperhand you are...”. What if this meant Month 1 sellers would be airdropped a Scarlet Letter of sorts, a non-transferrable token indicating that they were a paperhand?

What if loyal holders received the opposite of a Scarlet Letter, a Diamond Letter perhaps?

Outside of Holdium

These mechanics would have limited significance in the Holdium ecosystem itself. However if this Scarlet or Diamond letter were utilized in other ecosystems, things get interesting as these tokens would serve as a potential factor for whitelisting, blacklisting, multipliers, or penalties. Holdium holders could become airdrop magnets through inaction.

On the note of airdrop magnets, Pudgy Penguins have become one of the most prominent airdrop magnets in the industry since I introduced this concept 6 months ago. The Pudgy Discord even has a helpful command that shows all the opportunities for holders and it keeps growing.

One interesting factor that’s lacking from these airdrop claims for Pudgy holders (and other qualifying collections depending on the criteria) is something Holdium is addressing: time.

In these airdrops, each Pudgy Penguin receives the same amount of that respective airdrop (if you hold multiple you receive more, etc.). But what if someone buys a Pudgy Penguin just for an airdrop? There’s no bonus or penalty around time held (and in the grand scheme of things it’s not a big deal). This suggests there is an opportunity to reward long-term holders, and we see that in other ecosystems.

Another simple (and flawed) example of time as a factor is the credit score. Although it’s not the most important factor, it helps determine creditworthiness.

Understanding who should be rewarded for the actions that they take (or don’t) will matter more over time. The tools and methods to help determine and standardize this will become important resources in this space, and as crazy as it sounds memecoins might actually help.

Other interesting things

The Friendtech team is launching a new app, Friendcard

I’m going to be traveling for the July 4th holiday so no Thursday piece this week. See you next week!