Over the past couple of months, airdrop and points season went into full swing. We saw:

Blur conclude season 2 of their airdrop campaign while simultaneously announcing Blast

Portalcoin madness, filling the timeline with @Portalcoin tags

Apps like Rainbow Wallet announce points programs

Networks like Frame announce a token

Countless other apps and networks confirm or hint at an airdrop like Jupiter (Solana DEX), Smartlayer (executable token network), Manta (a modular EVM execution layer), and Grass (web scraping protocol). There are many many more I haven’t mentioned of course.

Writing this short list already has me feeling like this:

So much for that holiday break 😪

But that’s not what this is about. Rather I want to point out a couple of trends in this airdrop craze (trust me it won’t stop, so might as well get more familiar with how they work vs. ignoring them).

Before we get into that, let’s look at the typical methods to qualify for airdrops.

How do you even qualify for an airdrop?

Historically, the answer to this question was simple. The primary ways to qualify were through the following categories:

Holdings

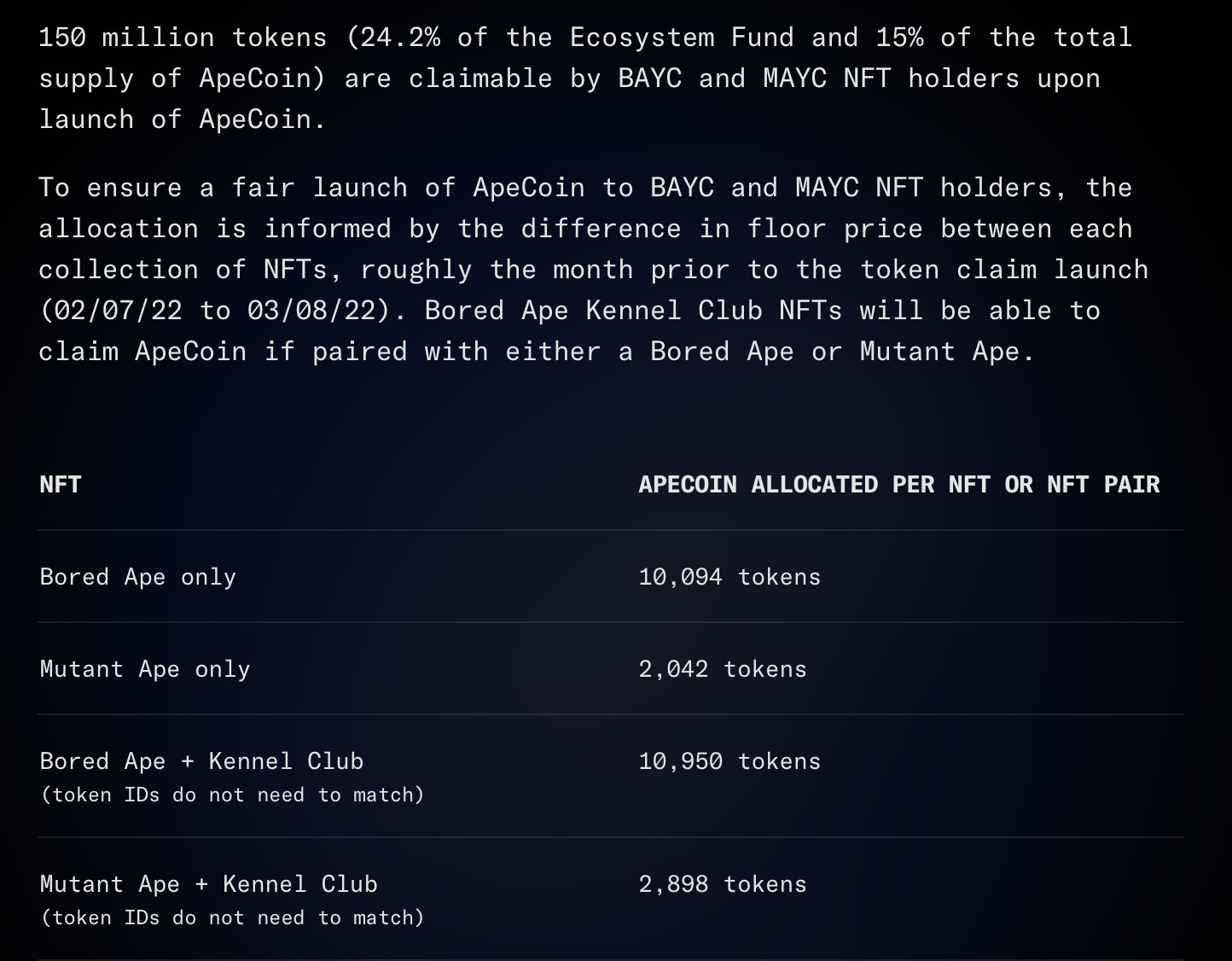

$APE: The token of the Yuga Ecosystem was airdropped based on the number of Yuga assets held

$ENS: The Ethereum Naming Service (a ‘.eth’ address) distributed 25% of their governance token supply to all addresses that registered a .ETH domain based on the total time of an address’ past and future registration as of the snapshot date.

Activity within a specific ecosystem

$ARB: Arbitrum (an Ethereum Layer 2 network) created a points system based on network activity to determine how many tokens each qualifying wallet would be airdropped

$ENS: The ENS airdrop also gave a small portion of the token allocation to active discord users and translators. Although the allocation was much smaller, the number of qualified users was much smaller.

Activity within a broader ecosystem

$BLUR: Since Blur wasn’t live yet, the first airdrop of Season 1 was based on total NFT volume traded across other NFT marketplaces.

$FRAME: The network also used NFT trading volumes as the primary factor for determining the airdrop allocation, and also included other factors like total royalties paid.

What are some parallels to this model?

Off the top of my head, there aren’t great examples that are like what I’ve laid out above. Some examples that are along the lines of them though…

NFT Allowlisting

By owning a ‘top’ NFT collection, holders can qualify for access to mint projects. A very relevant example of this is with CryptoUndeads, a mysterious but hyped project on that will be minting on Solana.

Although it’ll be very difficult to get access to mint a CryptoUndead, being a holder of the more highly-regarded collections in the NFT ecosystem helps increase your chances. Yesterday, the team announced that they selected 90+ collections and provided raffles to these communities for a chance to mint the collection.

So if you’re a holder, this is probably worth checking out and entering. You never know…?

Close, but still not the same as an airdrop. Nothing is guaranteed despite your historical actions.

NFT Honoraries

During the peak of the last NFT bull market, honoraries were a popular marketing tactic, with collections sending influencers and influential figures personalized versions of their collection to those individuals.

Bored Ape Yacht Club was one of the collections that brought this tactic to the forefront with the BAYC Honorary Members collection.

NodeMonkes, a popular Bitcoin Ordinals collection, also did this successfully.

This isn’t quite an airdrop (and if we consider it as one it’s a very subjective one). However, if we were to follow the airdrop framework, this follows the “Activity within a broader ecosystem” category. Most if not all honoraries are given to individuals who have made some sort of impact in the web3 ecosystem.

Web2 - Influencers

I still wasn’t satisfied with these examples, so a couple evenings ago I explained to my wife the idea I had around the concept of ‘airdrop magnets’ and asked her if there were other examples she could come up with.

As she digested the examples I gave, she lit up and mentioned influencers on social media.

Duh! 🤦♂️ TPan you idiot, this is what you get for being on X all day.

The specific example she was referring to was influencer gifting - A marketing tactic where brands send their products to influencers in the hopes that they review the products and give them a shoutout.

If we take a step back, influencer gifting is somewhat similar to the honoraries concept (less personalized though) and hits the various airdrop categories:

Holdings: These influencers don’t hold specific assets or NFTs, but they typically ‘hold’ a large number of followers

Activity within a specific ecosystem: Influencers are active on specific channels (Instagram, TikTok, Twitch, etc.)

Activity within a broader ecosystem: Influencers are focused on specific topics or niches (fashion, food, gadgets, etc.)

So in reality we do see airdrops outside of crypto and web3, but in a different format. And obviously, these airdrops aren’t tokenized.

Airdrop Magnets

Holy shit TPan, when will you get to the point?

Whoops, I’ll get to it.

The term ‘magnet’ is appropriate for this concept. The stronger the magnet, the stronger it can pull things toward its field.

For all the examples I’ve shared so far, these ‘magnets’ have different strengths:

If you held an ENS domain, you got an airdrop for the $ENS governance token, that’s pretty much it

If you traded a lot of NFTs, you could be eligible for airdrops across multiple platforms like $BLUR, $FRAME, and other ecosystems like Mintchain

If you are a notable figure in web3, you might get honoraries or opportunities to advise or angel invest in startups in the space

Over the past month, there’s been one airdrop ‘magnet’ that has shown the strength of its magnetic field.

Solana Mobile’s Saga phone

Despite popular gadget reviewer MKBHD giving the Saga the ‘Bust of the Year’ award, I would give the Saga the ‘Airdrop Magnet of the Month’ award.

The Saga has been one of the status symbols of the Solana ecosystem as a sign of early adoption, but also due to all the airdrops the phone has gotten so far. The phone cost $599 (price was reduced from $1,000 in December), and after selling out the phone has sold for several thousand dollars on eBay.

WTF, why?!

Each Saga phone comes with a Saga genesis token, a non-transferable NFT bound to the device, providing exclusive offers, content, benefits, rewards, and…airdrops.

The $1,264.60 figure above is at the time of this writing and suggests that this may be just the beginning for Saga owners.

Even when I searched ‘saga phone airdrop’ on X just now this was literally the first post that popped up.

Saga phone holders have suddenly become the Instagram/TikTok influencers and honorary NFT members by simply owning a phone. Following the same marketing tactic as I mentioned earlier, you can bet that Saga phone holders will gladly post about what they’re getting. And for engagement farming purposes non-owners are as well.

Other Airdrop Magnets

Although the Saga phone is the best example of an airdrop magnet so far, there are a few other examples of emerging airdrop magnets.

Celestia ($TIA) Stakers

Celestia is a modular blockchain network that helps to scale blockchains. The token has risen in price significantly over the past couple of months as well, adding to the buzz.

Celestia stakers have been rewarded with a number of airdrops including Saga and Dymension.

Pudgy Penguins

This one’s interesting because holding a NFT typically provides an airdrop specific to that ecosystem’s token or access to mint other NFTs. That’s not the case anymore.

The Dymension airdrop is also allocating a small percentage of its supply to several NFT collections, including Pudgy Penguins.

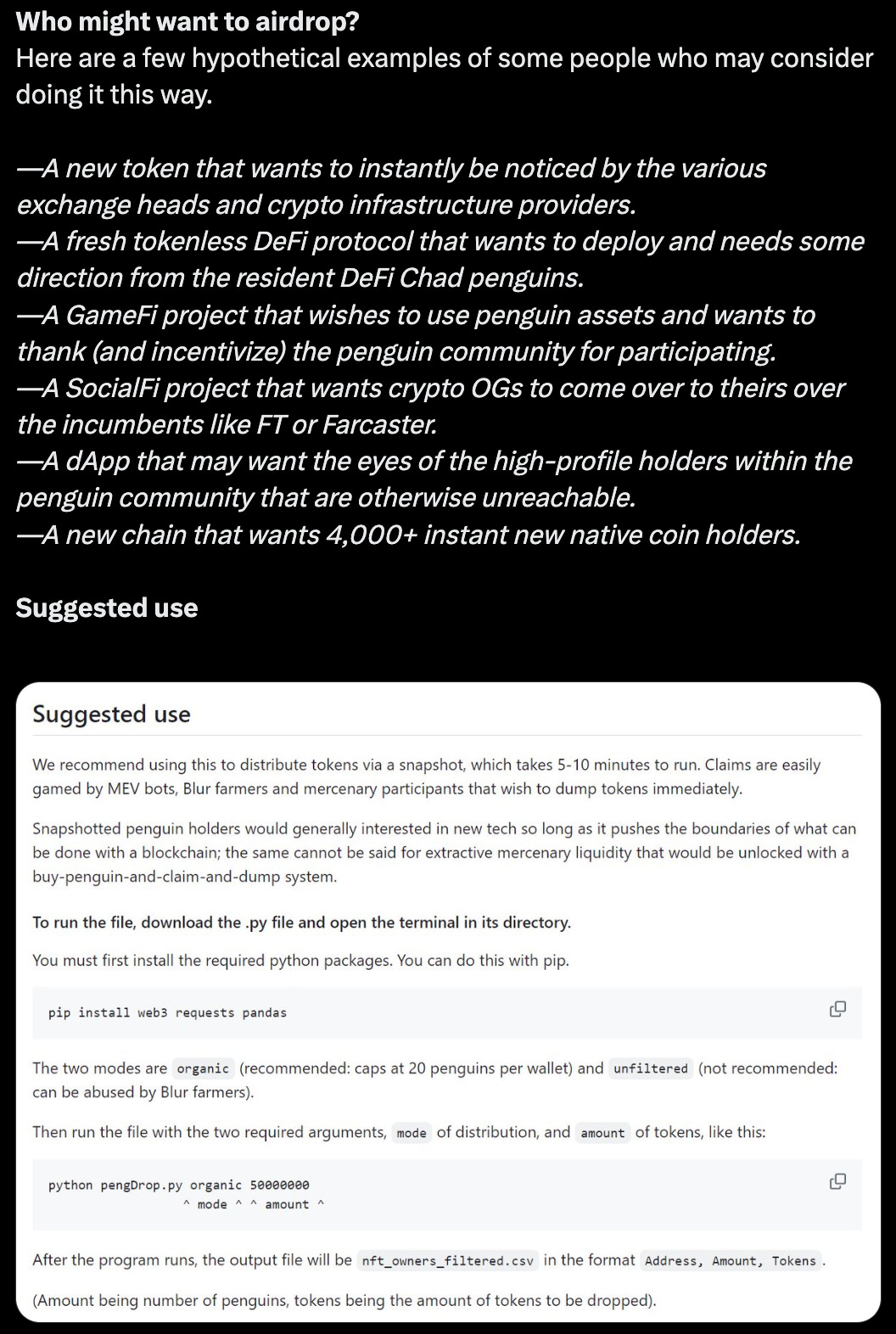

One enterprising Pudgy Penguin holder decided to take this one step further and created pengDrop, a script to help teams that planning airdrops to easily create logic to airdrop to Pudgy community.

Other airdrop trends

It doesn’t stop at airdrop magnets. There are two additional observations about some of these airdrops that caught my eye.

Airdrops are going cross-category

Dymension is a great example of this concept

Breaking this down into specifics who qualifies across these 3 categories?

Culture (NFTs)

Pudgy Penguins

Mad Lads

Tensorians

Bad Kids

Money (Token bridgers)

USDC

TIA

USDT

ATOM

ETH

SOL

Tech (Crypto users)

Celestia stakers

Ethereum L2 users (Arbitrum, Optimism, Base, Blast)

Cosmos ecosystem stakers

On a separate note, if you qualify or you think you qualify, it might be worth checking on Dymension’s airdrop page (not available in the US, but if you still want to check you know what to do…).

Airdrops are going cross-chain

Dymension’s airdrop logic above proves this point, and Saga’s airdrop criteria does too.

The scalability protocol incorporates similar logic giving the Cosmos, Celestia, Polygon, and Avalanche communities a piece of the token pie.

Why is this even happening?

If you’re overwhelmed reading about all these networks and qualifying criteria, I understand. It took me weeks to digest what was going on.

If you’ve heard the crypto term ‘the future is multichain’, then naturally the criteria will go multichain (and span multiple categories, collections, actions, etc.). And protocols/networks like Dymension and Saga are precisely that.

This isn’t just a user acquisition play. This aligns incentives and the broader narrative, bringing historically separate communities together.

Vampire attacks like Blur taking marketplace volume from OpenSea and Sushi forking Uniswap are very targeted and sometimes zero-sum.

This emerging category of airdrops seems to be much more of a 1+1=3 type of scenario. Almost like the concept of pollination, the opposite of a vampire attack? lol.

Airdrop magnets: Can they last?

Maybe, maybe not. I generally am in the camp that they can if you don’t blindly provide tokens to these magnets. Cobra has a point and the post he’s quote reposting from R89 does too.

This emerging airdrop magnet trend is still in its infancy and there will likely be different ways to coax out more quality from the trend. For example, if you hold a specific asset or NFT and take certain actions, you are deterministically eligible. That’s still a win for the holder because they know for a fact they qualify vs. speculating whether they do or don’t.

On the other hand, multichain and multicategory criteria have a significantly larger audience, so the saturation of that type of airdrop strategy will likely be slower.

The future of airdrops is certainly going to be interesting. May the (magnetic) force be with us all 🧲

See you next week!

Hey TPan,

airdrop may be like messaging between wallets, and any message has a unique utility/price

and this focuses on audiences

Airdrops might not last, I suspect they might come in waves? There's bound to be some fatigue at some point.

The reading of wallets as a marketing tool however is here to stay for sure