#316: Layer3's Layered Staking Model

🔭 Some emergent themes around token distribution and post-TGE

Last week I was notified that Layer3 released an eligibility checker. You know what that means — we’re getting an airdrop y’allllll ($)!

What is Layer3?

Layer3 is a questing platform with 1+ million active users, 40+ million quest completions, and 25 blockchains and ecosystems onboarded. The company has raised over $21 million in funding, with the most recent $15 million fundraising round announced in June.

If you want to dig deeper into Layer3 and the background, Wu Blockchain recently released a podcast episode with cofounder Brandon Kumar and published the transcript earlier today. Timely!

Checking in with the eligibility checker

Over the past year, I’ve played around with Layer3’s questing platform, completing 84 quests and minting 15 CUBEs (Credential to Unify Blockchain Events, a way to reward users and verify the completion of quests across different blockchains). Surely I was going to get something for my infrequent activity.

As I clicked my way over to the checker…

I wasn’t expecting anything significant, but I also wasn’t expecting to be ineligible. Fortunately, there was a ‘learn more’ button as I’m always receptive to constructive feedback, even if it comes in the form of a blog post.

How did Layer3 determine who qualified and who didn’t?

The primary requirement for qualifying for the S1 distribution: Mint at least 50 CUBE credentials by May 10. If you don’t meet this requirement, you don’t qualify, regardless of all other activity. No ifs, ands, or buts.

All of your historical activity is considered after meeting the minimum CUBE requirement. This includes historical activity such as CUBE credentials, level, quests completed, achievements, daily gm’s, bridge + swap volume, and more

To qualify for the S2 distribution, users had to mint the soulbound Trident NFT by July 22nd.

A few observations from these points.

Minting 50 CUBE credentials is a ‘gatekeeper’ requirement.

Did you complete 1,000 quests? Did you reach level 35? Doesn’t matter if you didn’t mint at least 50 CUBES.

Layer3 has determined this as the most important determinant of a user’s quality and it’s an appropriate one. Users that mint CUBEs directionally indicate a higher quality user because:

Minting CUBEs is not free. It currently costs ~$0.25 to mint a cube.

CUBE quests have requirements across different apps and chains, indicating deeper engagement

CUBEs launched in February 2024, so users who minted 50 were recently active and engaged

The Trident NFT is the ‘gatekeeper’ requirement for S2 eligibility

Even before the initial airdrop, Layer3 established what was needed to be eligible for Season 2: Mint the Trident NFT.

The Trident NFT is a combined version of 3 Infinity CUBEs, which required the completion of 30 different quests. It’s a soulbound token, so it needs to be earned vs. purchased/transferred.

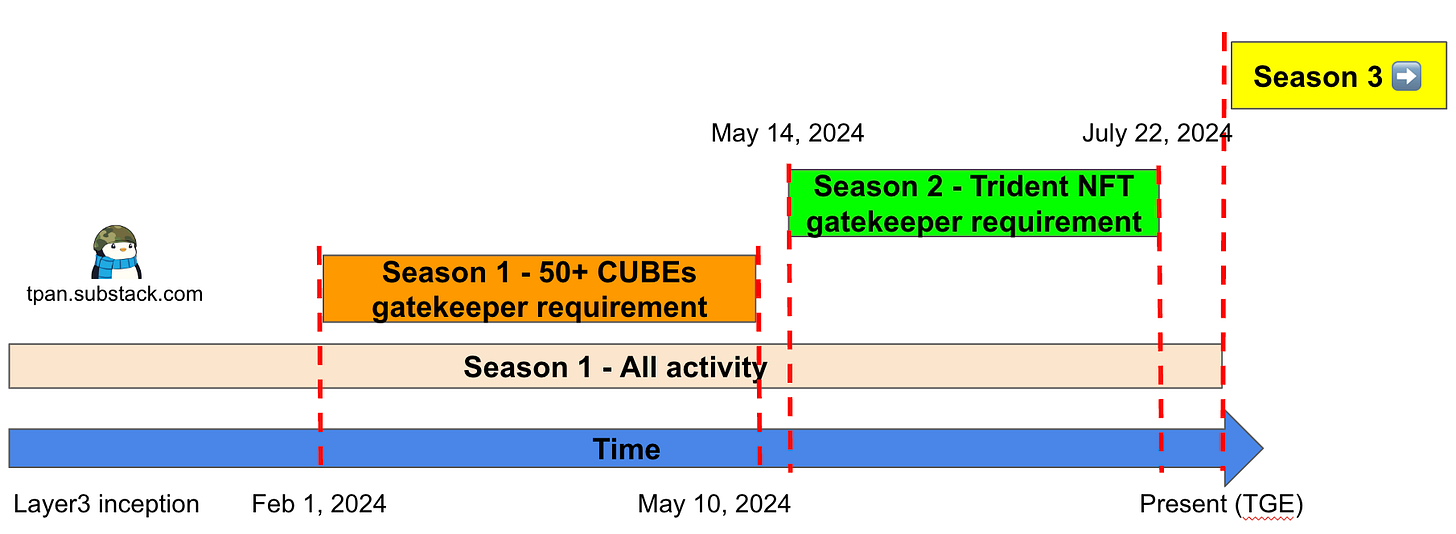

Digging deeper into the timing of S1 and S2, both seasons occurred prior to the actual TGE event. Breaking this down from a timeline perspective:

Not only did both S1 and S2 happen prior to TGE, they aren’t mutually exclusive. For example, S2 activity also contributes to the S1 ‘all activity’ consideration in the form of CUBEs minted, XP points, levels, etc. as long as the S1 gatekeeper requirement was met.

Showing this in a visual format creates a different way of thinking about the concept of seasons and how we don’t have to take them so literally. A new season doesn’t have to start when the prior season ends. They aren’t strictly mutually exclusive 🤔

Recency Frequency Monetary Value (RFM)

Another framework Layer3’s approach reminds me of the Recency, Frequency, Monetary Value (RFM) framework, which is often used for customer segmentation and analysis. The approach is relatively simple and can be applied here.

Recency

S1’s gatekeeper requirement lasted 3.5 months, concluding a couple months before TGE

S2’s gatekeeper requirement lasted 2.5 months, concluding one week before TGE

Frequency

S1’s total activity is taken into consideration once the gatekeeper requirement is met

Monetary Value

Minting CUBEs has a cost (albeit a small one) tied to it. This is one of the several tactics Layer3 implements to help address sybils and bot accounts

Many quests have bridging, swapping, lending, borrowing, or staking requirements, which also require capital. These actions help with quest completion for CUBEs and XP, but additional weight is given to the amount transacted when it comes to these specific actions as well

For Layer3, frequency matters in the context of recency, and monetary value is baked into recency and frequency.

Introducing Layered Staking and Layered Utility

As the disappointment around my airdrop ineligibility faded away and replaced by curiosity Layer3’s TGE approach, the eligibility blog post introduced another intriguing concept towards the bottom: Layered Utility. Time to dig into the tokenomics page. How does this concept work?

Layer 1: Passive Staking Rewards & Governance

Stake L3 tokens to passively earn additional L3.

Governance Participation

Layer 2: Actively Earn Other Tokens & Increased Utility

Users who stake a certain amount gain access to exclusive quests and incentives

Different tiers of rewards are unlocked based on the amount of tokens staked

Stakers receive early and extended access to new project launches

Stakers can participate in special incentive programs with varying tiers based on the amount staked

Layer 3: Actively Earn L3 token

Earn a multiplier on L3 airdrops based on your activity

Additional L3 tokens will be distributed to users and stakeholders through ongoing incentives, and stakers can earn a multiplier

Although this isn’t completely new (I think of Blast’s recent TGE event and their native yield feature, raffle tickets, and passive points earning mechanism), Layer3 is deliberate and explicit about why staking is valuable and why users should stay actively engaged with their platform beyond TGE.

These benefits also remind me of a piece I recently wrote about Yup, where the app provided early access to token holders above a certain threshold.

Levers to pull to incentivize action

Change the threshold: Increase or decrease the token requirement based on the predicted desirability of the feature

Add a time-based component: Reduce (or increase depending) the token requirement every day/week/month based on the feature rollout timeline and the capacity to address bugs

Stake or burn to access: If holding a certain amount of a token isn’t enough, staking shows even stronger intent for access if the incentive is juicy enough. Burning would be the strongest version of showing intent/interest.

Stake with progressive unlocks: Another variation of staking could be with unlocks to withdraw based on time, usage, both, or other criteria such as providing feedback.

Tiered access based on holdings: The more you hold or the longer you’ve held, the more access you get, especially if a feature will incorporate a credit or number of uses approach.

Historical behavior: You get access if you haven’t sold the token in the past X days/weeks/months or ever. This could be binary (you get access or don’t) or more nuanced.

Some of the active benefits for stakers fall into the categories I suggested (tiered access, stake to access, burn to access is not mentioned above but is mentioned in the tokenomics doc).

Additionally, Layer3 is explicit about distinguishing the passive vs. active benefits of staking the token. This ‘gives permission’ to different types of users. How so?

Users that have spent significant time, energy, and capital on Layer3: “It’s ok to passively stake and earn more L3 token. Come back to actively earn when you’re ready. You’re still a part of the family.” Ideally, they continue to stay active.

Users that haven’t spent significant time, energy, and capital on Layer3: “It’s ok if you joined the party late. Get active, stay active, and you’ll catch up to those who joined early in no time!”

Tokenizing Attention

The first sentence in Layer3’s tokenomics page sounds like a quote from a thoughtboi, but in reality it gets to the heart of one of the problem spaces that the onchain economy is looking to solve:

Attention is the most valuable resource on earth. L3 is the attention layer. It creates a global liquid market for attention, turning it into currency.

Beyond Layer3, the ‘passive vs. active’ distinction is a playspace that I believe will be explored by other builders. This line from the tokenomics page that describes how the Layer3 protocol values active participation explains why:

For example, a whale who does nothing gets proportionately less than a minnow who does a lot.

We can agree on why this makes sense, but we’re only in the early innings of the various ways this could work. Historically, capital engagement (via staking) has been a proxy for attention and will continue to be in many situations. You are using your capital and the act of parking it as a proxy for non-capital intensive activity, typically time.

Now we’re seeing a sliding scale type of approach applied with the understanding that Capital engagement ≠ User engagement.

After all in the words of popular writer Ralph Waldo Emerson:

Other interesting things

Swastik Garg shares a nice list of community-building and GTM articles

Substack adds Polymarket embeds. Interesting move by Substack, I wonder how this went down considering how negative the comments are. Big W for Polymarket though.

Zora proposes a new unit of measurement for Ethereum: Sparks

When it comes to a gatekeeper, I am always in the list of ineligible(nice word) or disqualified{bit harsh!:)}. Yeah, It's a harsh reality. Everything is based your spend habits! Crypto, USD or Rupee! :)